Alibaba's $3.8 billion targeted investment plan was completed today

As of last Friday, the closing price of Alibaba, a US-listed company, was 188.030 yuan, which coincides with the exit range of the US$3.8 billion investment plan formulated by Minglong Think Tank on December 21, 2024. This also indicates that the investment plan has officially entered the investment plan completion stage.

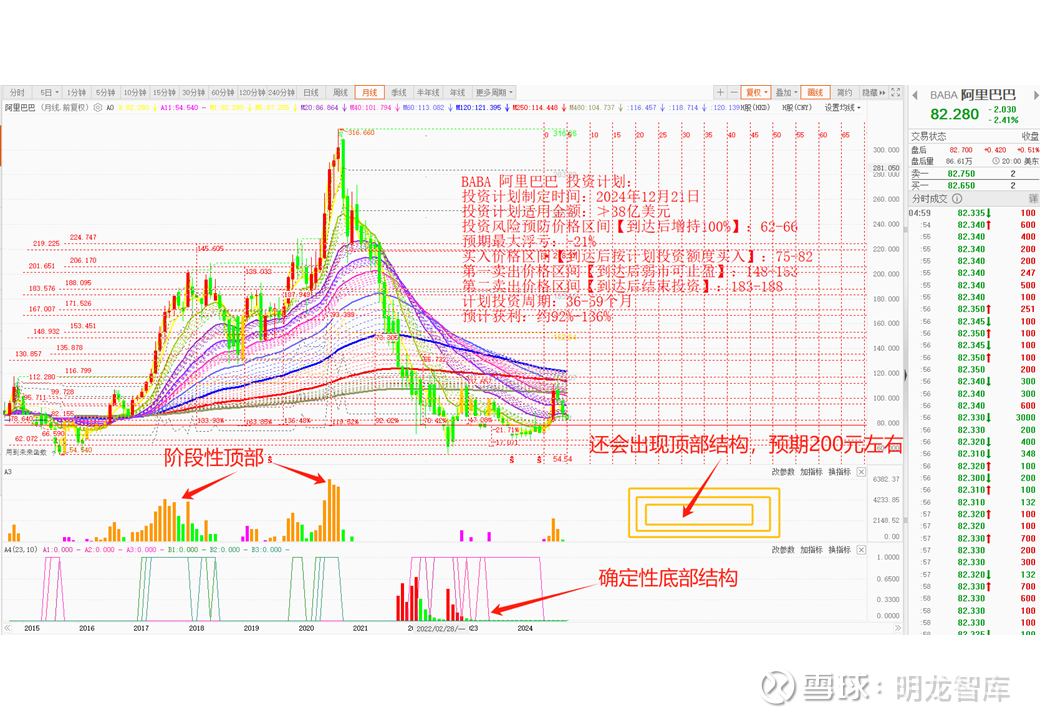

As can be seen from the screenshots in this article, the investment plan was established on December 21, 2024, when Alibaba's stock price was $82.280. The lowest price since the investment plan was formulated to date is US$80.06. It has been 11 months since the purchase plan was completed and held until now, with an amplitude of approximately 128% and an increase of approximately 115%. This means that the planned investment of $3.8 billion has already grown to approximately $8.17 billion, resulting in a profit of $4.3 billion.

Investment opportunities with gains exceeding 100% appear annually in the stock market, but the capital market lacks those with the skills to consistently execute long-term, trend-based investment strategies spanning hundreds of billions of yuan. Institutions and fund managers that can make long-term trend investments based on monthly cycles are scarce.

Today's article is not intended to announce the end of an investment plan, but to demonstrate the ability to discover investment opportunities and scientifically formulate investment plans. We can formulate hundreds of such investment plans with high certainty and high returns in the global market every year, but as a professional organization engaged in strategy research and investment process management, we lack market development capabilities and fund raising capabilities.

Therefore, we need to look for large investment institutions and investors around the world who recognize the long-term trend investment philosophy and adhere to the principles of equity and project-based securities investment as our business partners.

In order to verify our ability to discover investment opportunities, we are hereby announcing two investment opportunities we discovered in the past week, along with the investment plans we have developed, for everyone to verify.

UiPath lnc-A Investment Plan:

Investment Plan Development Date: October 6, 2025

Investment Plan Applicable Amount: ≥ US$150 million

Investment Risk Prevention Price Range [Increase holdings by 100% upon reaching the target]: 9.00-11.39

Expected Maximum Floating Loss During the Buy Period: -32%

Buy Price Range [Buy according to the planned investment amount upon reaching the target]: 13.86-15.41

First Sell Price Range [Take profit in a weak market upon reaching the target]: 37.38-38.78

Second Sell Price Range [End investment upon reaching the target]: 51.99-52.55

Planned Investment Period: 25-47 months

Expected Profit: Approximately 163%-250%

网页链接{《EVGO's Core Competitiveness and Development Prospects Research Report》}

EVgo Investment Plan:

Investment Plan Date: September 29, 2025

Investment Plan Applicable Amount: ≥ US$50 million

Investment Risk Prevention Price Range [100% Increase Upon Reach]: 2.39-2.78

Expected Maximum Floating Loss: -42%

Buy Price Range [Buy according to the planned investment amount Upon Reach]: 4.08-4.82

First Sell Price Range [Capitalize in a weak market upon reaching]: 13.80-14.28

Second Sell Price Range [End Investment Upon Reach]: 17.63-18.11

Planned Investment Period: 35-59 months

Expected Profit: Approximately 246%-327%

Our business development direction is: through monitoring industry trends and analyzing capital behavior, we help actual controllers and major shareholders of some listed companies to make reasonable asset allocation on a global scale. At the same time, through our investment behavior, we appropriately support some listed companies that are in industry downturns and development bottlenecks.

For details on our investment strategy, please leave a message.

#明龙智库# #投资策略# #今日话题# $上证指数(SH000001)$ $深证成指(SZ399001)$ $创业板指(SZ399006)$