美国房市affordability 搞起来

达沃斯可能有大动作~

$Builders Firstsource(BLDR)$ $Pool(POOL)$

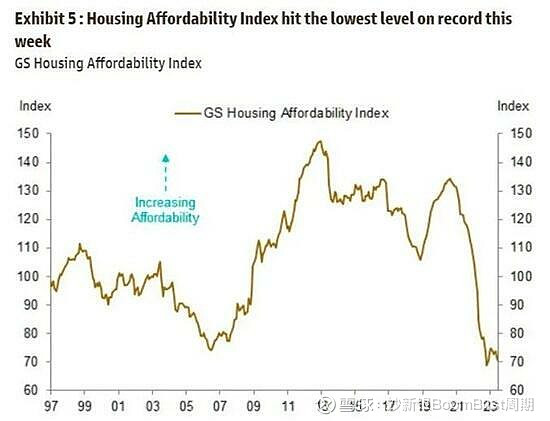

Affordability, particularly in the context of housing, has recently been a central focus for the Trump administration. In a national televised address delivered in December, the President announced forthcoming plans which he described as "the most aggressive housing reform plans in American history." According to media reports, President Trump is expected to introduce several initiatives aimed at enhancing housing affordability during his upcoming speech at the World Economic Forum in Davos. To date, two policies have been previewed, each of which has already had market moving impacts. In today’s Global Markets Daily, we discuss the impact of recently introduced policies and outline additional measures that may be under consideration.

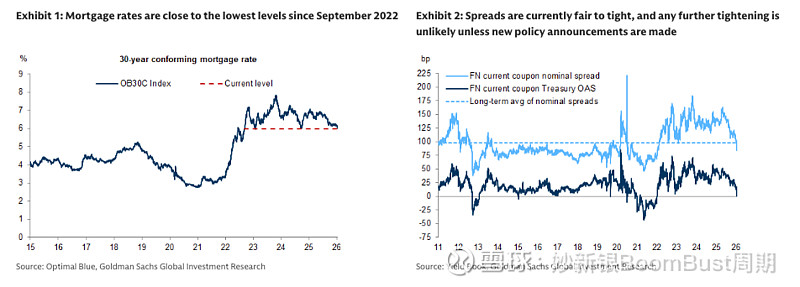

GSE MBS purchase program has already pushed mortgage rates lower by 15bp

On January 8th, President Trump posted on social media that he has instructed his representatives to buy $200 billion of mortgage bonds. Subsequently, Director Pulte and Secretary Bessent have essentially confirmed that the buying is being carried out by the government sponsored enterprises (GSEs) – Fannie and Freddie. Although very limited details about the program are available so far, the agency MBS market has quickly priced in the program with production coupon spreads tightening around 14-15bp so far. We believe the spread tightening so far is consistent with a program of this magnitude and hence believe that it is fully priced-in. Mortgage rates have also declined in tandem and are now close to the lowest levels since September 2022 (Exhibit 1). This should improve affordability and improve sentiment in the housing market ahead of the key spring homebuying season. We believe that the cumulative decline of around 80bp in mortgage rates since June 2025 could boost existing home sales by at least 5-7% in 2026 vs. 2025. Moreover, it is possible that the administration could push new Fed leadership to provide additional support to housing by reinvesting monthly run-offs from the Fed’s portfolio back into MBS. However, as we noted recently, if the $200 billion purchase program is a one-off, and there are no other MBS purchase programs from the GSEs/Fed/Treasury, then MBS spreads are likely to end the year wider vs. current levels. Agency MBS nominal spreads are already tighter vs. their longer-term average, and OASs are at levels last observed during the Fed’s QE purchase program (Exhibit 2). Therefore, the key risk for the housing market is that the decline in mortgage rates over the past two days reverses by the end of the year.