百思买。 市盈率15.8

市盈率(TTM):15.82市净率:6.4252周最低:62.30委比:66.67%市盈率(静):16.06市销率:0.47每股收益:5.87股息(TTM):3.75每手股数:1总市值:199.35亿每股净资产:14.45股息率(TTM):4.04%最小价差:0.01总股本:2.15亿

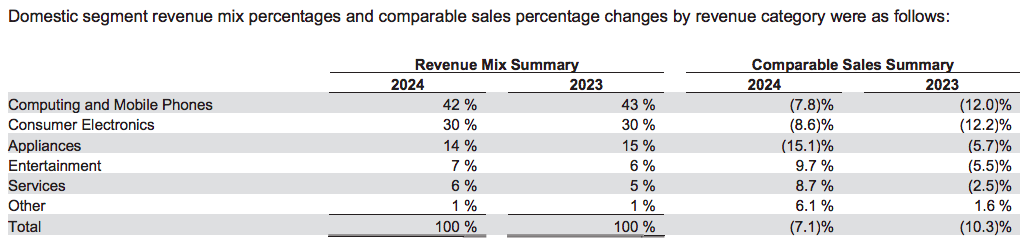

主要收入来自卖电脑和手机还有消费电子产品。占到收入的7成,剩余的占三成

Description of Business We were incorporated in the state of Minnesota in 1966. We are driven by our purpose to enrich lives through technology and our vision to personalize and humanize technology solutions for every stage of life. We accomplish this by leveraging our unique combination of tech expertise and a human touch to meet our customers’ everyday needs, whether they come to us online, visit our stores or invite us into their homes. We have operations in the U.S. and Canada. Segments and Geographic Areas We have two reportable segments: Domestic and International. The Domestic segment is comprised of our operations in all states, districts and territories of the U.S. and our Best Buy Health business, and includes the brand names Best Buy, Best Buy Ads, Best Buy Business, Best Buy Health, CST, Current Health, Geek Squad, Lively, Magnolia, Pacific Kitchen and Home, TechLiquidators and Yardbird; and the domain names bestbuy.com, currenthealth.com, lively.com, techliquidators.com and yardbird.com. Our International segment is comprised of all operations in Canada under the brand names Best Buy, Best Buy Mobile and Geek Squad and the domain name bestbuy.ca.

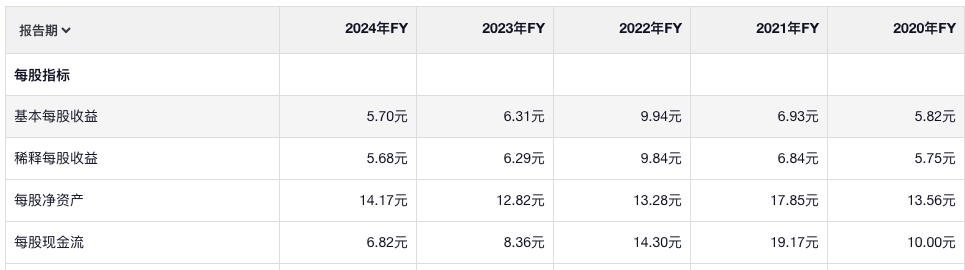

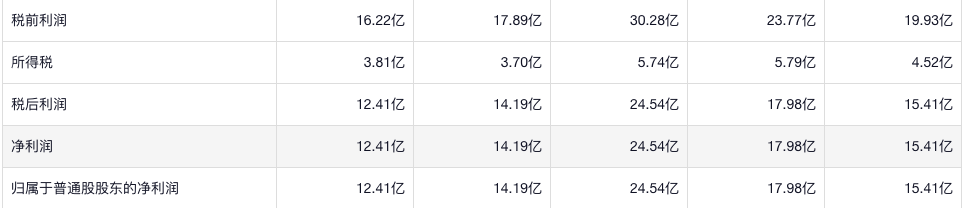

公司的每股收益增长了又在24年回落了,这业绩有点挣扎。现金流始终是大于净利润的,盈利质量是很好的

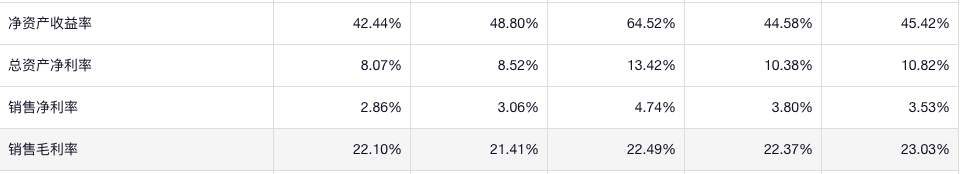

公司的负债率并没有高的离谱,算是偏高的那种,在这样的情况下,这个公司的净资产收益率也还是非常高的,毕竟这个公司的净利润率只有不到3%,roe达到42%,运营效率也是真高。

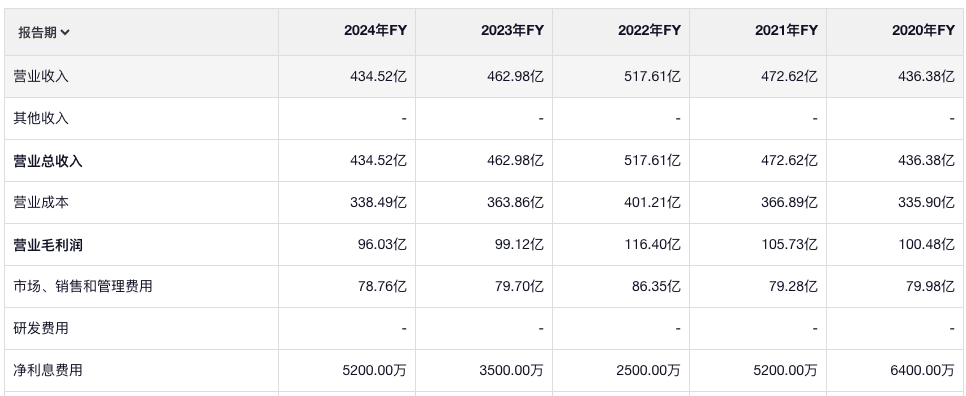

公司的营业收入增长很不明显,基本就是没有增长,净利息费用很少,不过一直有,美国公司在借钱这件事情还真是坚持

公司 的净利润最近三年是下降的,真不容易

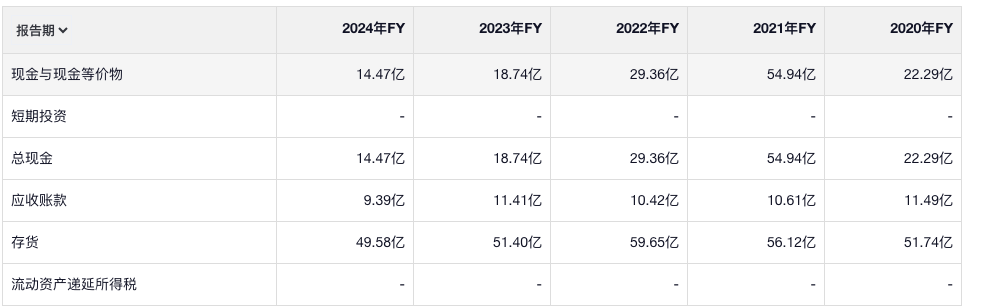

存货不多,应收更少,现金也很少

公司的账上的钱。有一部分上借的,真不理解为啥非要借这些钱呢

23年公司的分红是7.9亿,市值是199亿,分红回报率也不算低。

长期持有回报还是可以的,但是跟那些优秀 的公司比还是有差距的。

在一个成本的重要性高于一切的行业里,企业要为自己挖一条护城河绝非易事,这也是我们很难在工业材料企业中看到护城河的主要原因。无论矿山采掘、化工材料、炼钢还是汽车配件,要通过差异化让产品做到与众不同几乎是不可能的事情。