巴菲特致股东的信原文精读Day792:

原文:Though our primary goal is to maximize the amount that our shareholders, in total, reap from their ownership of Berkshire, we wish also to minimize the benefits going to some shareholders at the expense of others. These are goals we would have were we managing a family partnership, and we believe they make equal sense for the manager of a public company. In a partnership, fairness requires that partnership interests be valued equitably when partners enter or exit; in a public company, fairness prevails when market price and intrinsic value are in sync. Obviously, they won’t always meet that ideal, but a manager—by his policies and communications—can do much to foster equity.(1996)

释义:1.“reap”意为“收获回报”;

2.“sync”意为“同步”;

3.“foster”意为“促进”。

精译:尽管我们的首要目标是让伯克希尔全体股东的持股利益最大化,但我们也力求股东之间互摸腰包的利益最小化。如果我们管理的是一家家族合伙企业,希望达成这些目标。我们认为,对于上市公司高管而言,这些目标同样适用。在合伙企业中,为了公平起见,当合伙人进入或退出时,要求其权益的估值合理;在上市公司中,当市场价格与内在价值趋于一致时,公平性才得以实现。显然,二者并非总能完美契合,但公司高管完全可以通过制定政策和加强沟通,尽可能地促进公平。(1996年)

心得:巴菲特的目标有二:首先,要让所有股东的整体利益最大化;其次,要让股东之间尽量公平,相互之间尽量少占便宜。只有当企业经营良好且股价合理时,才能同时达成上述目标。企业经营良好与否,很大程度上取决于高管的努力;股价是否合理,虽然高管无法控制,但是可以通过持续的宣导来施加影响。伯克希尔作为一家上市公司,股价却很少大起大落,就得益于巴菲特多年来的金融科普和教育。

朗读:大家请自由发挥,哈哈哈!大家的手抄原文,也可以在评论区上传打卡。

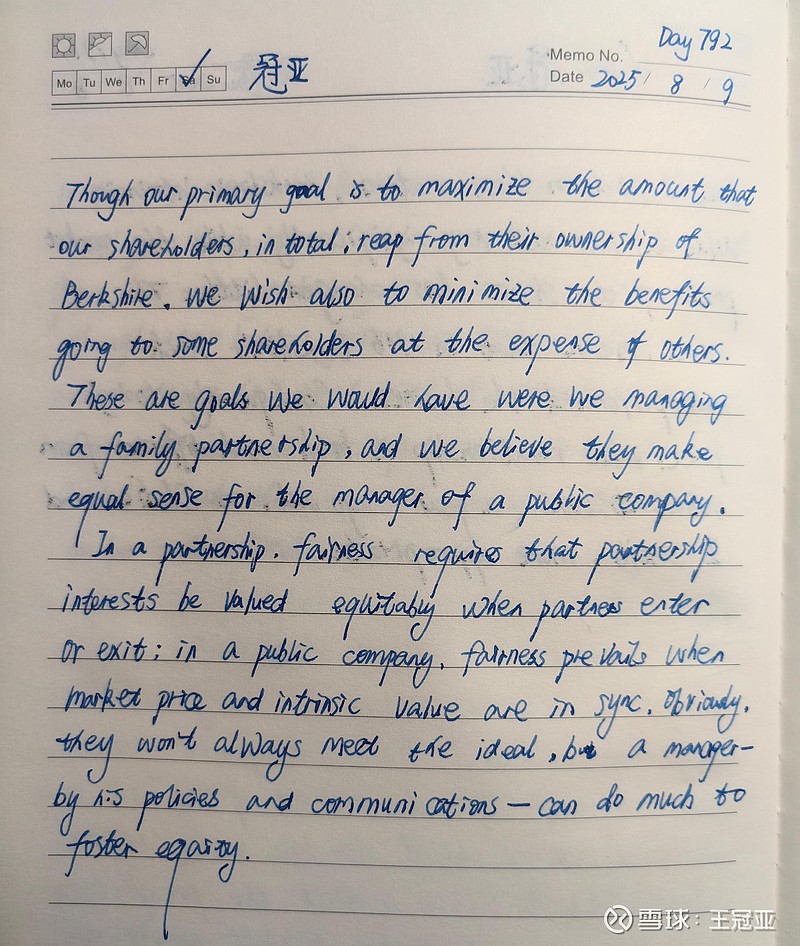

手抄: