巴菲特:澄清伯克希尔不会收购CSX运输,为什么?

"For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments."(“对于投资者来说,为一家优秀公司的股票支付过高的购买价格,可能会抵消掉其后十年商业发展的有利影响。”) ——巴菲特: 1982年伯克希尔·哈撒韦致股东信。

CNBC最新资讯报道,巴菲特不会收购CSX运输公司,以下是具体报道细节。

【新闻快讯】

伯克希尔·哈撒韦排除收购CSX的可能性,选择建立合作伙伴关系

在一条新闻快讯中,CNBC的贝基·奎克(Becky Quick)报道,她刚刚与沃伦·巴菲特(Warren Buffett)通了电话,巴菲特就CSX公司和伯克希尔·哈撒韦旗下的BNSF铁路公司最近发布的新闻稿提供了重要澄清。巴菲特先生证实,伯克希尔·哈撒韦目前无意收购CSX或任何其他铁路公司。

决策细节

据巴菲特透露,他与格雷格·阿贝尔(Greg Abel)于8月3日,在奥马哈会见了CSX的首席执行官乔·辛里奇斯(Joe Hinrichs)。会议在巴菲特的办公室举行,没有顾问在场。在讨论中,巴菲特和阿贝尔向辛里奇斯明确表示,伯克希尔·哈撒韦不会对CSX提出收购要约。

取而代之的是,他们提议在BNSF和CSX之间展开深度合作,以实现与公司并购所能达成的同样运营协同效应。上周五发布的新闻稿详细说明了这一合作伙伴关系的框架。其目标是创建一个无缝的货运网络,能够将货物从东海岸运送到西海岸,而无需经历在不同铁路线之间转移货物通常所需的重大延误(往往长达两到三天)。

巴菲特强调,这种安排的一个关键优势是,BNSF拥有“无限的资源”来投资于任何符合逻辑意义的项目,从而允许在合作关系下进行重大的基础设施和效率改进。

市场影响与基本原理

这一声明为投资者提供了至关重要的背景信息,因为近几个月来,由于银行家们对潜在收购要约的猜测,CSX的股价已大幅上涨。通过寻求合作而非并购,伯克希尔·哈撒韦可以在不支付高昂的CSX股票收购溢价的情况下,实现其战略目标。

巴菲特还扩大了他的声明范围,澄清伯克希尔目前不考虑竞购任何铁路公司。这平息了关于他们可能与联合太平洋公司(Union Pacific)竞购其他铁路资产的传言。

分析师评论与市场反应

报道发布后,分析师指出,市场此前已在CSX的股价中计入了交易溢价,部分原因是激进投资者的存在使该公司处于“待售”状态。随着伯克希尔·哈撒韦这个主要潜在竞购者现已正式退出,这部分溢价正在从股价中被剔除。

这一消息也印证了CNBC的大卫·法伯(David Faber)早前的报道,他当时指出双方并未进行任何并购谈判。

在贝基·奎克的报道播出后,CSX的股价应声下跌3.75%。分析师指出,尽管CSX的市值约为620亿美元,但与伯克希尔·哈撒韦持有的巨额现金储备相比,这只是一个相对较小的数字。这一决定反映出,当伯克希尔已经通过全资拥有BNSF而对美国经济有了重大敞口时,它不愿再朝这个方向投入更多资本。

【禅兄解读】

CSC运输是否符合巴菲特的收购标准?

根据巴菲特长期公开的收购标准,CSX运输公司(CSX Transportation)在很多方面都非常符合巴菲特的理想收购目标特征,但在最关键的一点上不符合,那就是“合理的价格”。

1、符合巴菲特标准的部分:

(1)业务简单,易于理解

完全符合。 巴菲特已经拥有美国最大的铁路公司之一BNSF(伯灵顿北方圣太菲铁路公司)。他对铁路行业的运作模式、盈利方式和面临的挑战了如指掌。这完全在他的“能力圈”之内。

(2)具有持久的竞争优势或“护城河”

完全符合。 铁路行业拥有巴菲特最看重的宽阔“护城河”。

高准入门槛: 建立一个新的铁路网络几乎是不可能的,因为成本极其高昂,并且获得土地路权的难度极大。

寡头垄断: 在美国东部,CSX与诺福克南方公司(Norfolk Southern)形成双头垄断,竞争有限。

成本优势: 对于长距离运输大宗商品(如煤炭、谷物、化学品),铁路运输比卡车运输成本更低、燃油效率更高。

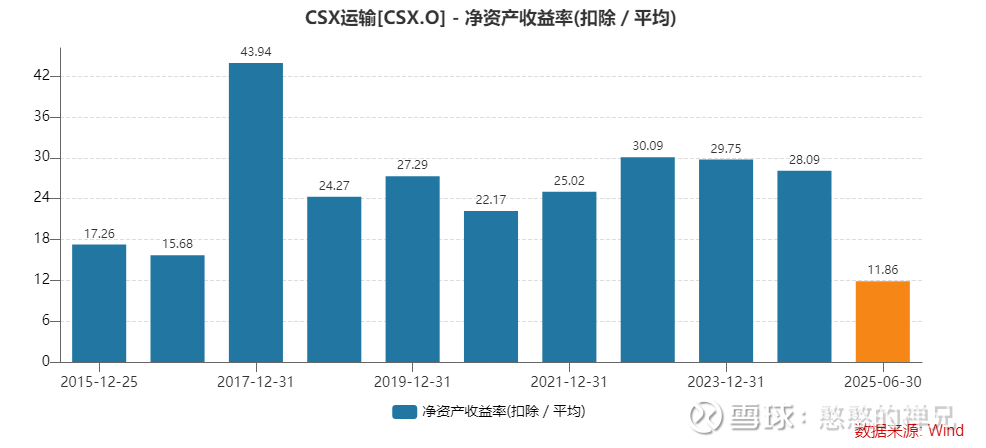

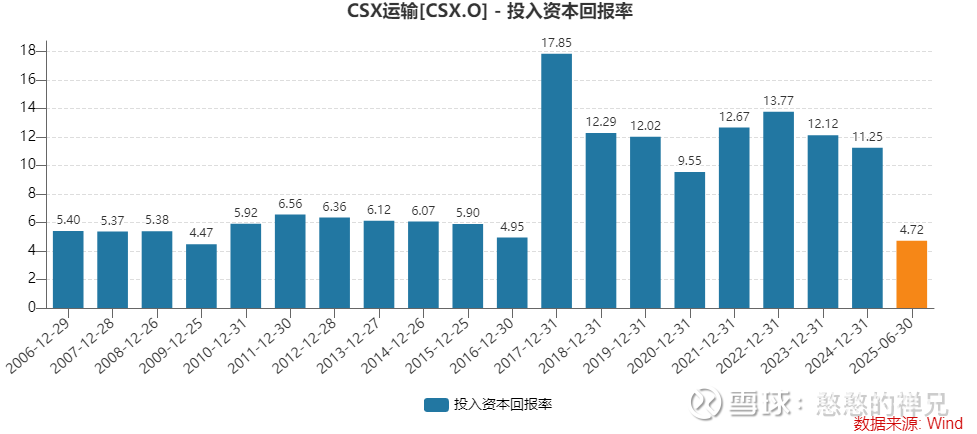

(3)有持续稳定的盈利能力

符合。 作为美国经济的基础设施核心部分,大型铁路公司拥有悠久的历史和稳定的盈利记录。虽然其业务会受到经济周期的影响,但其长期盈利能力已得到证明。巴菲特喜欢投资这种历史悠久、业绩可预测的公司,而非初创或需要扭亏为盈的企业。

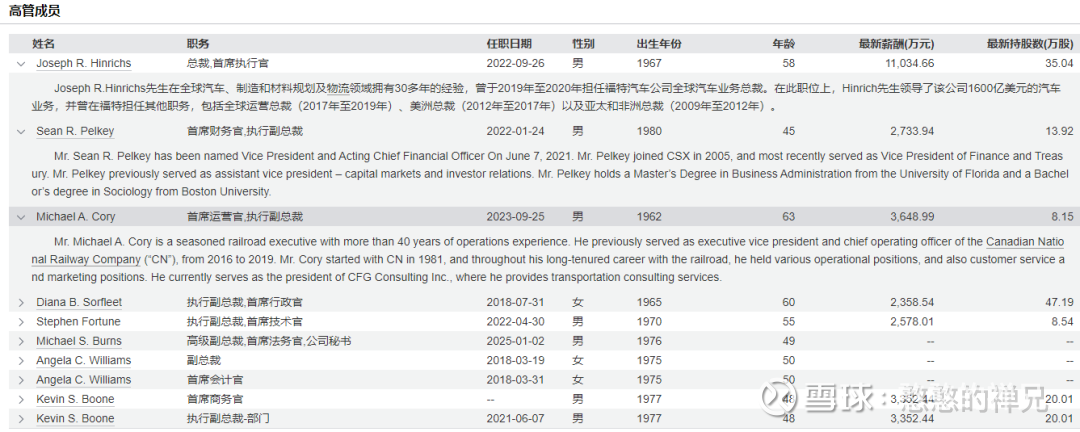

(4)有能力且值得信赖的管理层

符合。 CSX拥有成熟的管理团队。巴菲特的模式是收购优秀的企业并保留其管理层,而不是亲自下场经营。

下图分别是CSX公司董事会成员与高管成员!

(5)大规模收购

符合。 根据报道,CSX的市值约为620亿美元,这对于手握巨额现金的伯克希尔·哈撒韦来说,是一个规模足够大的收购目标。

2、不符合巴菲特标准的部分:

(1)合理的价格

完全不符合。 这是这笔交易未能发生的核心原因。正如新闻报道中贝基·奎克(Becky Quick)明确指出的:由于市场上流传着收购的猜测,CSX的股价在过去几个月里已经“大幅上涨”。

巴菲特选择通过“合作”而非“并购”的方式,正是为了在不支付高昂收购溢价的情况下,获得同样的协同效应。这充分体现了巴菲特作为价值投资者的纪律性:无论一家公司多么优秀,他都不会为其支付过高的价格。当价格变得不合理时,他会毫不犹豫地放弃收购。

(2)债务问题 (特殊情况):

巴菲特通常偏爱负债率低的公司。然而,铁路是典型的资本密集型行业,需要持续巨额投资来维护和更新轨道、机车等设备,因此通常负债水平较高。但由于巴菲特已经拥有BNSF,他完全理解并接受这个行业的这一特性,因此这一点虽然不完全符合字面标准,但不会成为他收购的障碍。

CSX公司在业务模式、竞争壁垒和市场地位上,几乎是为巴菲特量身定做的投资标的。它是一家巴菲特能理解、拥有强大护城河、且规模巨大的优秀公司。然而,最终决定性的因素是价格。当市场对收购的预期将股价推高后,这笔交易对于巴菲特来说就不再是一笔划算的买卖。

他选择了一种更聪明、成本更低的方式(合作),来获取他想要的商业利益,这恰恰证明了他对“安全边际”和“不出高价”原则的坚守。

【附:英文全文与中文翻译】

Scott:

Hang with me for a second because we have a news alert with Becky Quick, who joins us now, I believe, on the phone. Hey Becky, what you got?

Becky Quick:

Hey Scott, I just got off the phone with Warren Buffett and he just added a little clarity to the news release that both CSX and Burlington Northern put out on Friday. In it, they talked about how they're linking up; they've got a lot of partnership that they can work together on to make sure that freight can make it all the way from the East to the West Coast and that there's this cooperation between them. The clarity to add to this is that Berkshire Hathaway is not in the market to buy a train company right now. That is what I heard from Mr. Buffett himself, who said that back on August 3rd, he and Greg Abel met with Joe Hinrichs, who is the CEO of CSX. They met in Omaha, alone in his office, no advisors or anybody else involved. They talked through all of it, and Buffett and Abel made clear at that point that they were not going to be making a bid for CSX, but they really thought there was a lot that they could do to cooperate and work together and come up with those same synergies that there would be even if the two companies were combined.

Now, that letter that you saw on Friday, the press release that was put out, kind of detailed how they can do that partnership together, what they're planning on doing. And Buffett tells me that, by the way, the huge advantage here is that BNSF has unlimited resources to spend on anything that they think makes sense. So this is really a way to get freight across the country for their customers without having any of the slowdowns or shutdowns or needing to take two to three days to transfer over to another train line. But they would be working this out, but without actually putting a deal on the table. And that's important because if you've been watching CSX shares over the last couple of months, as bankers have talked about the potential for a deal, well, you've seen those shares really pick up a huge amount. This is a partnership that would get at that without paying that premium to do it.

But the two companies seriously have a lot that they can do together. Buffett also told me that, by the way, it's not just CSX. They're not in the market to bid for any train company at this point. There has been some speculation that maybe they would put out a competing bid against Union Pacific for the other railroads, but that's not in the cards at this point either. So, just some important context to a developing story that's been out there for a couple of months and that we've seen along the way, and it's probably worth paying attention to all of those train shares today.

Scott:

Well, we continue to follow his every move. Obviously, Becky, you've been at the forefront of this from the very beginning. Did he give you any indication broadly, or did you take anything away from your conversation about this particular deal, on how he views the current market environment at all?

Becky Quick:

Just the current market environment for the train stocks? I mean, look, obviously they've run up a lot. He didn't say anything specifically about it, but what I would take away from it is, yeah, if you're an investor who's getting into these stocks because you think there's going to be a big deal that happens, that's not the case. You know, there's a partnership that can be had. I don't know if you guys remember, just like a week ago, the Commerce Secretary, Howard Lutnick, was on "Squawk on the Street" and he was talking about some of these things. David Faber asked him about the potential for the deal, if the Trump administration would be in favor of that. And he said he was going to stay out of it; it wasn't his view to get things done.

But even Howard Lutnick looked at it and said, look, there are certainly synergies that could be out there, but we don't care if it gets done through a merger or if it gets done through cooperation between the two companies. It was very eerie. What he was talking about is very similar to what these two companies just announced on Friday. Because there are still questions as to whether the Trump administration would even approve a combination of these companies. We'll see. The Surface Transportation Board would be the one who would okay all of those things. But if the market is looking for another bidder to come in over Union Pacific or another big bid to go through with CSX, it's not going to come from Berkshire Hathaway.

Scott:

Yeah, and I mean, maybe the market... well, looking at the price action as you were delivering this report, which is clearly moving CSX, maybe the market's doubtful of that as well, of somebody else maybe entertaining this. Becky, thank you so much for the reporting and for calling in to the show.

But Mike, I'll get your comment here as well on, you know, Buffett and co.

Mike:

Yeah, I mean, I think just the resistance to kind of throwing more capital in this direction. I'm sure they feel as if BNSF is great exposure to the overall U.S. economy. Any efficiencies you can get with this sort of joint cooperative deal with CSX? Also, of course, I think the market was naturally going to that place when it came to an activist investor in CSX. You have, at least nominally, these companies in play. So you have one potential bidder outright removed from that. So you have to take some of that premium back, and the stock's going back to where it was about a month and a half ago.

Scott:

Yeah. Well, I mean, Faber this morning on the air, I mean, we've done well to surround this thing between Becky and David. He reported this morning that no talks were being had either. So we continue to try and advance the ball, at least as it pertains to that reporting. Latest from Becky there, moving CSX down 3.75%. So that's an interesting one.

Mike:

I was just going to say, you know, it's like a $62 billion market cap right now. I mean it's a small number for the mountain of cash that Berkshire is sitting on.

Scott: Exactly. And, you know, they're in the market for big deals, but it doesn't seem as if this is the particular area where they want to necessarily get messy with that.

斯科特(Scott): 请稍等一下,我们有一条来自贝基·奎克(Becky Quick)的新闻快讯,我相信她现在正在电话线上。嘿,贝基,你有什么消息?

贝基·奎克(Becky Quick): 嘿,斯科特,我刚和沃伦·巴菲特(Warren Buffett)通完电话,他为CSX和伯灵顿北方公司(Burlington Northern)上周五发布的新闻稿做了一些澄清。新闻稿中谈到他们将如何连接起来;他们有很多可以合作的伙伴关系,以确保货物能够一路从东海岸运到西海岸,并且双方之间存在这种合作。需要补充说明的澄清是:伯克希尔·哈撒韦(Berkshire Hathaway)目前无意收购任何铁路公司。这是我从巴菲特先生本人那里听到的,他说早在8月3日,他与格雷格·阿贝尔(Greg Abel)就和CSX的首席执行官乔·辛里奇斯(Joe Hinrichs)见了面。他们在奥马哈巴菲特的办公室单独会面,没有顾问或任何其他人在场。他们深入讨论了所有事情,巴菲特和阿贝尔当时就明确表示,他们不打算对CSX提出收购要约,但他们确实认为双方在合作方面大有可为,可以共同努力,并实现与两家公司合并后才能达到的同样协同效应。

现在,你周五看到的那封信,也就是发布的新闻稿,详细说明了他们将如何进行合作,以及他们计划做什么。顺便说一下,巴菲特告诉我,这里的巨大优势在于BNSF(伯灵顿北方圣太菲铁路公司)拥有无限的资源,可以投入到任何他们认为有意义的事情上。所以,这确实是一种为客户实现全国货物运输的方式,而不会有任何减速、停运,或者需要花费两到三天时间转运到另一条铁路线上的麻烦。但他们会通过合作解决这个问题,而不是真正地提出一笔交易。这一点很重要,因为如果你在过去几个月里一直关注CSX的股票,当银行家们谈论潜在交易的可能性时,你会看到那些股票真的涨了很多。而这种合作关系可以在不支付那笔溢价的情况下达到目的。

但这两家公司真的有很多可以一起做的事情。巴菲特还告诉我,顺便说一下,这不仅仅是针对CSX。他们目前无意竞购任何铁路公司。之前有些猜测说,他们可能会针对其他铁路公司提出与联合太平洋公司(Union Pacific)竞争的报价,但目前看来这也不在计划之中。所以,这只是为一个已经发酵了几个月、我们一直在关注的事件提供了一些重要的背景信息,今天可能值得关注所有这些铁路股。

斯科特:好,我们会继续关注他的每一步动向。显然,贝基,你从一开始就处在这件事的最前沿。关于他对当前市场环境的看法,他有没有给你任何宏观的暗示,或者你从这次关于特定交易的对话中领会到了什么?

贝基·奎克:只是关于铁路股的当前市场环境吗?我的意思是,看,很明显它们已经涨了很多。他没有具体评论这一点,但我的理解是,是的,如果你是一个因为认为会有大交易发生而买入这些股票的投资者,那现在情况并非如此。你知道,可以达成的是一个合作伙伴关系。不知道你们是否还记得,大概一周前,商务部长霍华德·卢特尼克(Howard Lutnick)参加了《Squawk on the Street》节目,他当时也谈到了这些事情。大卫·法伯(David Faber)问他关于这笔交易的可能性,以及特朗普政府是否会支持。他说他会置身事外;推动事情发生并非他的职责。

但即便霍华德·卢特尼克也看了看说,听着,肯定存在协同效应,但我们不在乎这是通过合并还是通过两家公司之间的合作来实现。这非常诡异。他当时谈论的内容与这两家公司周五刚刚宣布的非常相似。因为关于特朗普政府是否会批准这样的公司合并,仍然存在疑问。我们拭目以待。地面运输委员会(Surface Transportation Board)将是批准所有这些事情的机构。但如果市场在寻找另一个竞购者来超越联合太平洋,或者另一笔与CSX的大交易,那这个竞购者不会是伯克希尔·哈撒韦。

斯科特:是的,我的意思是,也许市场……嗯,看看在你播报这条新闻时的价格走势,它显然在影响CSX,也许市场也对此(有其他竞购者)持怀疑态度,怀疑是否还有别人在考虑这件事。贝基,非常感谢你的报道和来电。

但是,迈克(Mike),我也想听听你对巴菲特及其公司的看法。

迈克:是的,我的意思是,我认为这只是反映了他们不愿意朝这个方向投入更多资本。我肯定他们觉得BNSF已经是美国整体经济的一个很好的风险敞口。你能从这种与CSX的联合合作协议中获得任何效率提升吗?当然,还有,我认为当CSX出现一个激进投资者时,市场自然会朝着那个方向去想。至少在名义上,这些公司已经处于“待售”(in play)状态。所以现在你有一个潜在的竞购者被直接排除了。因此,你必须把那部分溢价拿掉,股价正在回到大约一个半月前的水平。

斯科特:是的。嗯,我的意思是,法伯今天早上在节目中,我们(贝基和大卫)已经很好地从各方面报道了这件事。他今早报道说,双方也没有进行任何谈判。所以我们继续努力推进这件事,至少在报道层面是这样。贝基的最新消息让CSX下跌了3.75%。所以这是一个有趣的进展。

迈克: 我正想说,你知道,它现在的市值大约是620亿美元。我的意思是,对于伯克希尔坐拥的如山般的现金来说,这是一个小数目。

斯科特: 完全正确。而且,你知道,他们确实在市场上寻找大交易,但这似乎不是他们特别想去掺和的领域。

原创观点不易,希望各位能够多多支持!你的一个点赞、一次转发、随手分享,都是禅兄前进的最大动力~

日拱一卒,让我们一起慢慢变富!

朋友们记得“点赞+关注”