布鲁克菲尔德资产管理(BAM):如何在未来实现20%复利增长?(一)

2025年9月17日,布鲁克菲尔德资产管理公司总裁康纳·特斯基(Connor Teskey)就公司如何在当前和未来市场中赢得胜利发表演讲。

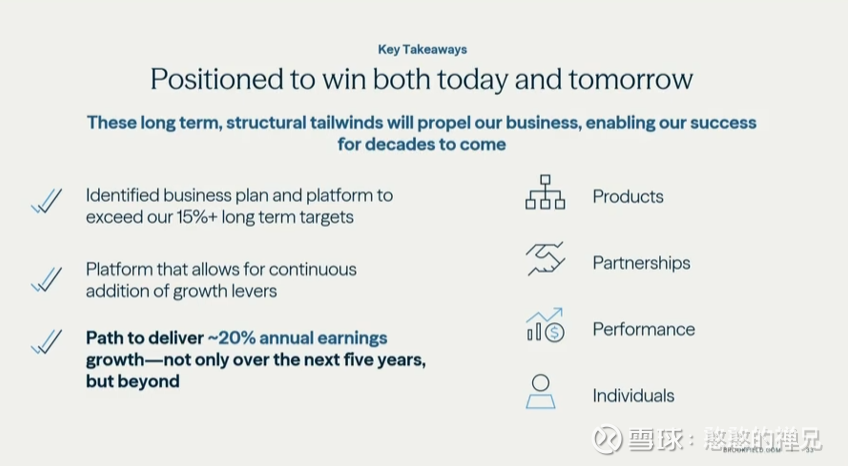

布鲁克菲尔德资产管理公司将复杂的战略浓缩为“顺应大势、四大驱动、20%增长”这几个简单清晰的要点。

以下是本次演讲的视频、中文翻译与英文原文,禅兄解读将出现下一篇文章(会重点提到英伟达、宁德时代、ASML等公司,它们的成功与布鲁克菲尔德资产管理有共同的基因)。

雪球无法分享视频,这是链接:网页链接

【中文翻译】

去年我们做这个演讲时,我们解释了我们的平台如何准备在5年内实现规模翻倍,这甚至超过了过去25年所实现的增长。今年,我们打算传达我们如何不断为业务增加新的增长杠杆,这将使我们不仅在短期内,而且在更远的未来,都能超越我们的长期盈利目标。

今天,布鲁克菲尔德资产管理公司是全球领先的、专注于实物资产的另类资产管理公司。我们在五个关键垂直领域(基础设施、可再生能源与转型、私募股权、房地产、信贷)管理着超过一万亿美元的资产,我们采用独特的“所有者兼经营者”模式,为我们所有的策略和产品提供具有吸引力的风险调整后回报。我们的平台、全球影响力和规模使我们能够实现这一业绩。但正是我们对关键资产和服务——全球经济支柱的关注,确保我们始终处于全球最大、最具吸引力的投资主题的核心位置。

我们通过一个本质上全球化的、不可替代的平台来执行这项业务,这个平台使我们能够在全球所有最具吸引力的市场中募集和部署资本。我们利用实地派驻人员,使我们能够在我们开展业务的全球每个市场中,为我们的每项策略进行投资、运营和募资。这不仅为我们的成功和增长提供了平台,也为我们提供了无与伦比的全球视野,以识别世界各地的新趋势,无论这些趋势源于何处,我们都可以定位我们的业务以加以利用。

Tips:

美洲 (Americas):超7300亿美元 资产管理规模 (AUM),850名投资专业人士

欧洲与中东 (Europe & Middle East):超2300亿美元 资产管理规模 (AUM),300名投资专业人士

亚太地区 (Asia Pacific):超1500亿美元 资产管理规模 (AUM),200名投资专业人士

正如我们多年来一直所说的,当今全球最大的投资主题是数字化、去全球化和脱碳化。与我们去年所说的类似,这些主题之所以吸引人,是因为它们各自的增长机会和资本需求如此巨大,以至于超过了上市公司和政府所能提供的。这就为私人资本创造了一个巨大、有吸引力且不断增长的机会。而且这个论断在今天比去年更为真实,比我们四五年前开始谈论“3D”主题时要真实得多。我们继续相信,最大、最具吸引力的机会属于那些能够在一个或多个这些动态的核心地带进行规模化运营的人。

当您审视我们的平台、我们在市场中的地位以及我们所处的前沿主题时,您会发现我们的业务不仅能在不到5年内实现规模翻倍,还能随着时间的推移,以可复制的方式不断增加新的增长杠杆。这使我们能够实现高达20%的年同比复合收益增长,不仅在短期内,在长期也是如此。

我们之所以能做到这一点,是因为我们已经拥有并持续巩固的领导地位。而这种领导地位是任何人都很难复制的。它是通过数十年来,以少有人能及的规模和稳定性,持续提供具有吸引力的风险调整后回报而建立起来的。

tips:

领导地位源于:卓越的风险调整后回报、穿越周期的稳健表现、规模优势、精准的资产类别选择

其重要性在于:进行更大规模的募资、吸引更多元化的资本基础、获取专有交易流、预见趋势并迅速行动、推出新战略

然而,我们对全球经济支柱的关注以及对核心资产的持续专注,有时会掩盖我们业务中一个我们认为未被充分认识的组成部分,那就是我们通过不断发展我们的平台,以利用下一个任何巨大且有吸引力的机会,来持续努力维护我们的领导地位。通过这样做,我们可以继续从更广泛的投资者群体中募集更多资本。

同样,我们可以持续地产生专有交易流,识别新趋势,并继续推出和扩展满足市场及客户需求的新产品和新策略。当我们思考未来将继续增加这些新增长杠杆的动力是什么时,有四个方面:产品、合作伙伴关系、业绩和个人投资者。

让我们从产品开始。布鲁克菲尔德拥有成熟的内在能力来扩展我们已有的策略,但我们同样拥有独特且可复制的能力,去开发、建立并推出新的策略,以满足全球不断变化的市场需求和客户要求,以及在这些策略中推出独特定制的产品,以服务于现在正寻求另类投资敞口的、日益广泛的投资者群体。

我们能非常高效且有效地做到这一点,因为我们已经在另类投资领域最重要和增长最快的细分市场中拥有了大型且领先的平台。当我们推出一个新的邻近或互补产品时,它并非从零开始,而是可以利用该资产类别中已有的现有全球平台。这使我们能够以可重复的方式,非常迅速地、以高成功率和强大的利润率来做到这一点。

稍后哈德利(Hadley)会上来解释我们的五年计划。她将展示的是,我们最大的产品,即我们的旗舰产品,它们继续在非常迅速地扩大规模。但我们未来增长中越来越大的一部分现在来自于互补和辅助产品。而这并非新鲜事。

这是一个持续了十多年的过程的一部分,我们系统性地寻求在我们拥有的每个垂直领域中,为我们服务的每种投资者类型,提供跨越债务、股权和结构化解决方案的全套产品和服务。这已经体现在我们的业绩中。今天我们超过70%的费用收入来自于过去十年推出的产品和策略。我们预计这些策略将在我们五年计划的募资中占据约三分之二的份额。那么,这方面有哪些具体例子呢?

tips:这两张图的对比,是理解布鲁克菲尔德增长故事的关键。

它清晰地展示了一条战略路径:首先,在自己最强的领域(私募股权、房地产、基础设施)做到全球顶尖,建立强大的品牌和平台(2015年的状态);然后,利用这个强大的平台信誉和资源,向整个资本光谱进行“复制”和“扩张”,为所有类型的投资者提供全方位、一站式的解决方案(今天的状态)。

这不仅带来了管理规模的巨大增长,更重要的是构建了一个更加稳健、多元化、能够穿越不同经济周期的“全天候”业务模式。

在过去10年里,我们建立了一个信贷业务,如今占我们全球收入的30%,并以每年超过20%的速度增长。我们做到这一点,并非试图面面俱到,而是通过利用我们已有的领导地位。我们拥有领先的实物资产融资业务,这得益于布鲁克菲尔德在实物资产领域的历史性领导地位。我们拥有领先的机会型信贷业务,这得益于橡树资本(Oaktree)的历史性领导地位。我们还拥有最大且增长最快的资产支持融资业务之一,这得益于Castlelake、Primary Wave及我们其他合作伙伴管理公司的领导力。

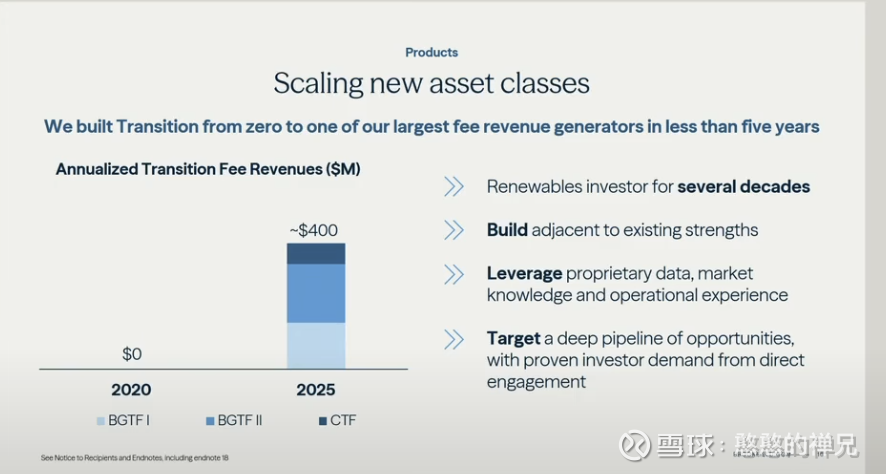

但这并不总是需要10年。有时速度可以快得多。2021年,我们利用在可再生能源领域数十年的往绩记录,推出了我们有史以来的第一个能源转型产品。在不到五年的时间里,我们现在拥有的这项业务每年能产生超过4亿美元的收入。该策略中的每一款产品在其规模上都处于市场领先地位。我们之所以能够做到这一点,仅仅是通过利用布鲁克菲尔德内部已有的能力、平台和知识。

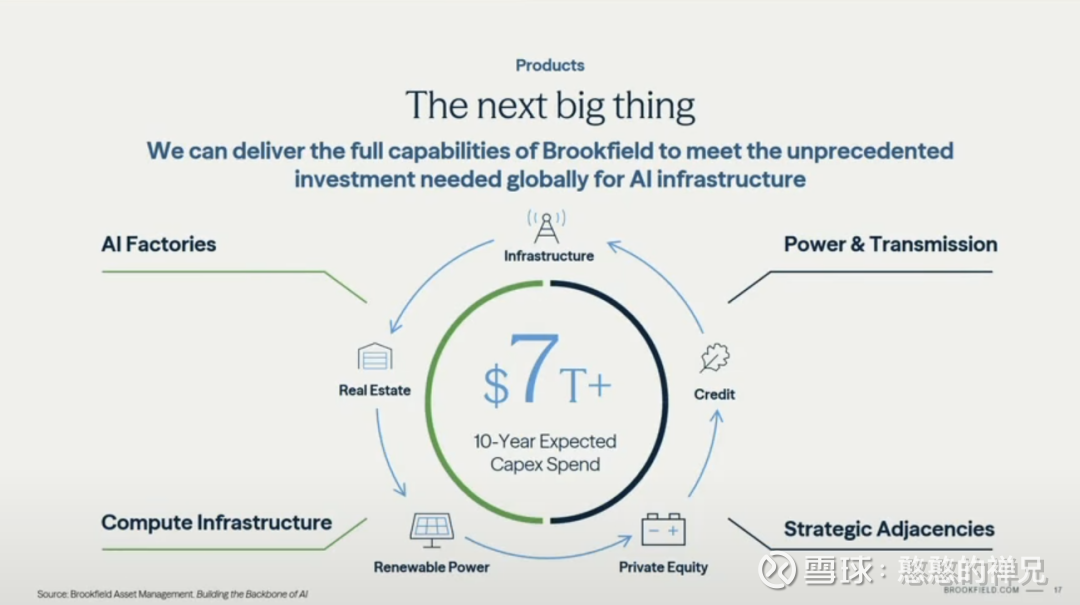

而且这并非昙花一现。我们已经看到历史在重演。今天,为人工智能(AI)基础设施的增长提供资金,无论是在这个国家还是在世界各地,都存在着一个巨大的市场机会。而这一策略将需要一个独特的资金池,专门用于该主题内的投资组合。鉴于我们在数字基础设施领域的领导地位、我们与超大规模数据中心运营商的关系、我们在先进制造业的经验,以及我们在全球范围内横跨传统可再生能源和核能的领先电力业务,我们认为我们有能力推出一个市场领先的AI基础设施业务,今天晚些时候你们将在专题讨论会上听到更多相关信息。

接下来,让我们转向合作伙伴关系。布鲁克菲尔德是独一无二的。我们的“所有者兼经营者”模式,通过将布鲁克菲尔德的大量资本与我们的有限合伙人(LP)合作伙伴共同投资而形成的一致性,以及我们专注的行业特定知识和经验。这使我们与众不同,并使我们成为世界上最大、最重要的组织在寻求战略和增长举措时备受追捧的交易对手。

我们提供大规模、灵活资本解决方案以及交付交易确定性的能力,为我们提供了一个巨大且有吸引力的专有交易流管道,我们无需在资本成本上竞争,并且能够通过我们的私募基金向客户提供这种交互式部署。再次强调,这并非理论。

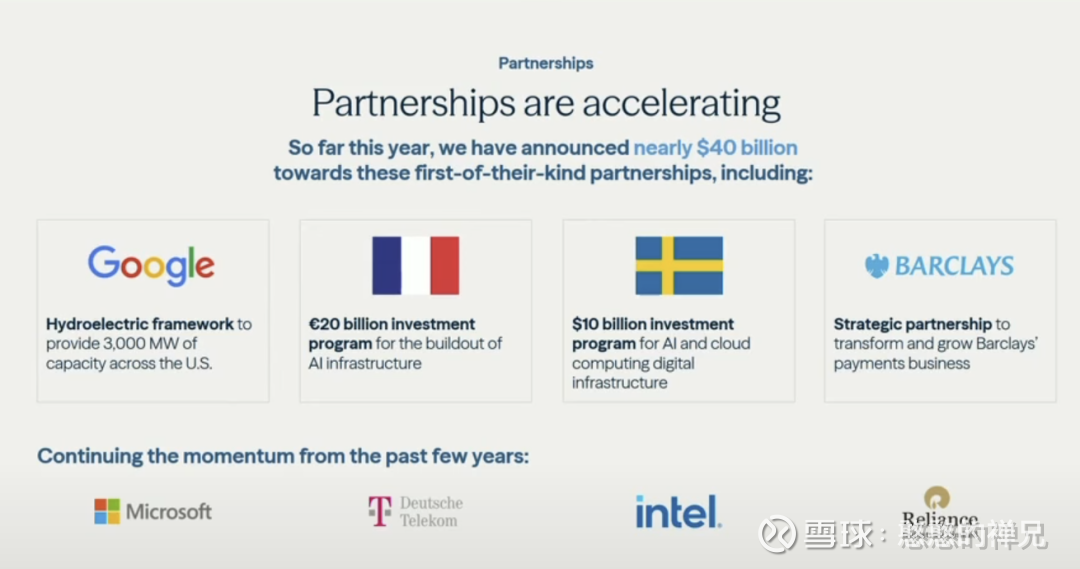

仅从我们在2025年宣布的双边合作伙伴关系中,我们就有400亿美元的未来部署机会。这还不包括我们在今年之前宣布的、并且已经在持续部署资本的合作伙伴关系。显然,我们可以利用这个有吸引力的交易流来扩大我们现有的一些策略,但我们也可以用它来推出新的策略。比如我们与巴克莱(Barclays)的合作关系正在帮助我们推出金融基础设施基金,或者我们的主权AI合作伙伴关系正在帮助我们推出AI基础设施平台。

tips:近期合作案例

谷歌 (Google) 达成水电框架协议,在美国各地提供3,000兆瓦 (MW) 的电力容量。

法国 (France) 达成200亿欧元的投资计划,用于建设人工智能 (AI) 基础设施。

瑞典 (Sweden) 达成100亿美元的投资计划,用于AI和云计算数字基础设施。

巴克莱银行 (BARCLAYS) 建立战略合作伙伴关系,旨在转型和发展巴克莱银行的支付业务。

这些合作伙伴关系不仅仅是资金安排。通过与全球最大、最成熟的组织紧密合作,我们持续不断地寻找更多合作方式。我们可以成为他们的运营伙伴。他们可以成为我们建筑物的租户。我们可以为他们管理养老金。他们可以成为我们资产的承购方。我们可以在未来共同寻求新的投资。随着我们业务的增长,这些伙伴关系只会与我们一同扩展。

tips:最佳的合作伙伴关系解锁最佳的机遇

为何合作伙伴关系至关重要:大规模的专有交易流、 提升运营业务的价值、卓越的风险调整后回报

这些合作伙伴不仅是交易对手方,也日益成为:投资者 (Investors)、承购方 (Off-takers)、租户 (Tenants)、合资伙伴 (JV partners)

我们能够启动并执行这些伙伴关系,能够推出这些产品,是因为我们业务的基石——即我们长期以来提供极具吸引力的风险调整后回报的卓越往绩。我们以价值为导向的方法,以及我们对具有长期现金流的核心、耐用资产的关注,提供了一个能够在整个市场周期和多种经济环境中表现出色的平台。

这在今天尤为重要,因为公开市场变得更加波动,一些寻求另类投资敞口的新投资者越来越重视下行保护、一致性和流动性。而这正是我们所能提供的。通过持续投资于高质量的业务,我们可以继续扩展到实物资产中最大、最具吸引力的领域,但这些领域必须能够继续提供多年来定义我们业务的一致性和回报弹性。这对于我们目标锁定的个人投资者以及寻求另类投资敞口的保险公司尤为重要,他们既想要那些超额回报,又想避免困扰该行业一些参与者的非流动性和波动性。

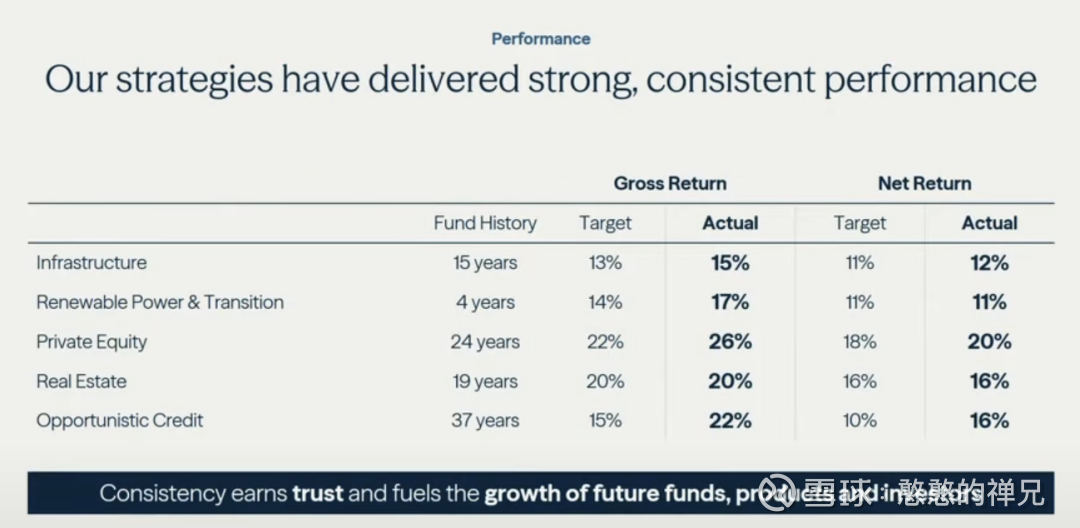

再次,这体现在我们所有主要策略和产品的业绩中。从长期来看,我们已经达到或超过了我们的回报目标。这是我们在持续扩张规模时不会妥协的一点。我们的投资纪律和产品创新纪律将确保即使在我们的平台扩张时,我们也能继续保持这一往绩记录。

但关于保险还有一点要说。我们对能产生现金流的高质量核心资产的关注,使布鲁克菲尔德免受了近期困扰另类投资行业的一些流动性问题的影响。我们专注于能够产生稳定且不断增长的现金流的业务,特别是避免那些需要高估值退出才能产生回报的投资。这使我们有更多选择,可以对业务进行再融资或变现,以便为有限合伙人(LPs)提供分配,即使市场条件不理想。

以房地产和私募股权为例。在这两个市场领域,关于资本回报微薄的说法最为普遍。仅在2025年或最近的12个月里,我们实际上经历了我们分配最活跃的时期之一,这反映了我们投资组合的高质量。

tips:三个核心数据

150亿美元 ($15B) :今年迄今已出售的房地产资产

100亿美元 ($10B) :过去24个月内已返还的私募股权客户资本

20% :基础设施和可再生能源业务创造的回报率

这使我们的平台与众不同,并将为我们提供下一阶段的增长动力,特别是对于那些希望进入另类投资市场的新投资者而言。这就引出了我们的第四个增长杠杆,即个人投资者。

今天,世界各地有更多来自不同投资类型的人希望获得另类投资的渠道。随着这一趋势的发生,我们看到了自我们推出旗舰基金以来,我们平台可能面临的最大增长机会。我们不仅准备充分、定位良好以利用这一机会,我们还认为随着这个市场的不断增长,我们可以占据不成比例的市场份额。

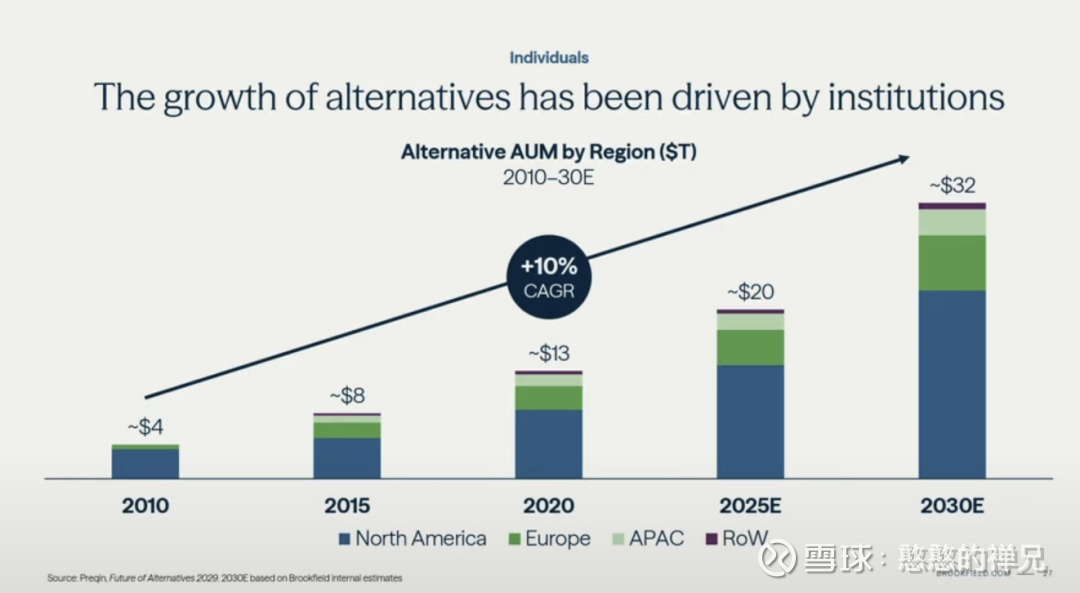

这里的背景很简单。二十年来,随着机构投资者将其更多投资组合配置到另类资产,另类投资市场一直在增长。这里需要提醒的重要一点是,这一趋势并未放缓。机构继续向另类资产配置更多资金,仅此一项就可能在未来10年内使另类市场的规模翻倍。

Tips:按地区划分的另类资产管理规模(单位:万亿美元)

市场规模从2010年的约4万亿美元,增长至2025年预测的约20万亿美元,并将在2030年达到约32万亿美元。

是的,虽然布鲁克菲尔德正努力为更广泛的投资者提供另类投资,但我们继续看到机构内部的显著增长。大型机构投资者继续将其资本集中于少数几家具有规模、往绩记录和产品以满足其全球需求的管理人的动态,持续使我们受益,因为在这一点上,我们自认首屈一指。更具体地说,在布鲁克菲尔德内部,机构市场中仍有一些领域我们才刚刚触及皮毛。以欧洲为例。

tips:机构投资者客户将进一步增长

资本正在向拥有以下特质的领导者集中:全球化的规模、多元化的产品组合、投资高增长资产类别的渠道、卓越的过往业绩

在以下领域仍有拓展机构客户的空间:中端市场的养老金、企业养老金、家族资本、欧洲投资者

多年来,我们一直大量向该市场部署资本,但历史上我们并未在那里募集同样多的资金。我们预计今年在欧洲募集的资本将是去年的三倍。我们的家族资本业务仍处于起步阶段。这些是我们机构平台中可以实现不是20%或30%,而是未来每年增长两到三倍的部分。

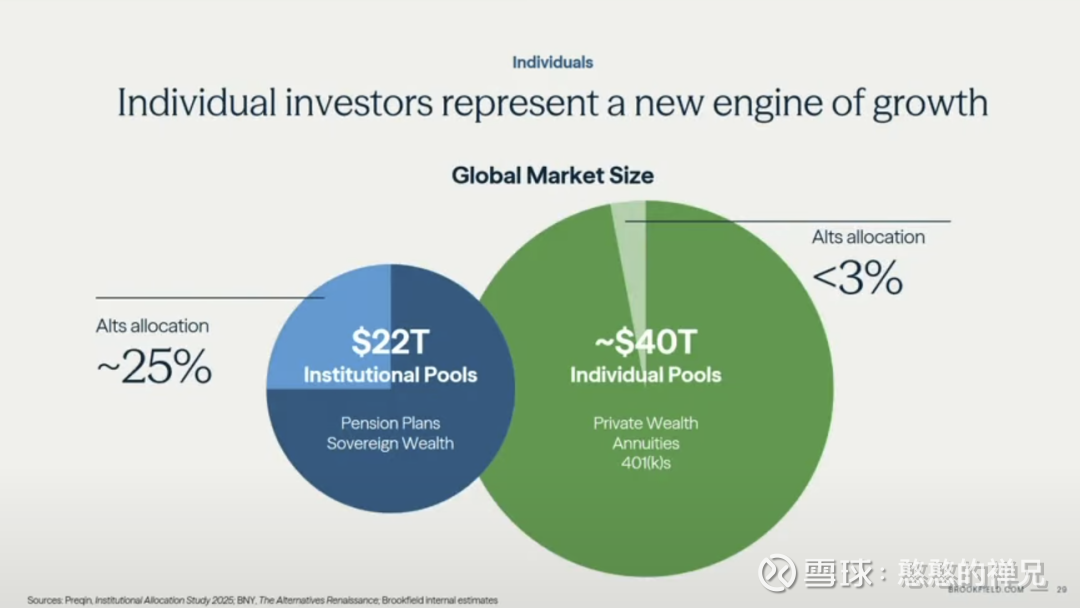

但如前所述,每个人都认识到,我们正处于另类投资领域最大增长机会之一的早期阶段,那就是向个人投资者提供另类投资。这就是您的高净值或零售投资者,您的年金或保单持有人,您的401k或退休市场。这个市场令人兴奋,因为它不仅在全球范围内比机构市场更大,而且目前对另类资产的配置比例更小。在未来的几年里,由于法规和投资者需求的变化,我们预计对另类资产的配置将大幅增加。

tips:个人投资者代表着新的增长引擎

图示对比:

蓝色圆圈(机构资金池):22万亿美元 机构资金池

养老金计划

主权财富基金

另类资产配置比例:约25%

绿色圆圈(个人资金池):约40万亿美元 个人资金池

私人财富

年金

401(k)s (美国退休金计划)

另类资产配置比例:低于3%

脚注: 来源:Preqin,《2025机构配置研究》;纽约梅隆银行 (BNY),《另类资产的复兴》;布鲁克菲尔德内部预测。

我们已经走在这一趋势的前沿。通过橡树资本(Oaktree)——我们的高净值和零售平台,我们今年将募集100亿美元。这比去年高出50%以上。随着我们推出更多专为该分销渠道设计的产品,我们期望保持这一势头。我们目前正在推出一款私募股权产品,并将在年底前推出另一款信贷产品。同样,在保险和年金方面,我们已经是向该领域提供另类投资的最大的提供商之一,不仅通过我们持续快速扩张的BWS服务,也通过以单独管理账户(SMAs)的形式向第三方保险公司提供另类投资。

tips:个人投资者的关注要点:四大关键要素规模、品牌、产品组合、过往业绩

当我们审视谁将在向个人投资者提供另类投资的竞争中获胜时,我们认为是那些拥有规模、品牌和往绩记录的公司。在这一点上,我们认为自己无与伦比。但也许更重要的是,这些投资者希望从另类投资中获得超额回报,但他们更看重流动性、一致性和下行保护。而我们对作为全球经济支柱的核心关键资产的关注,与满足这一市场需求完美匹配。在这些另类投资领域,没有人比我们规模更大。因此,我们认为我们最有能力随着时间的推移向个人市场提供这些产品。

那么,我们今天在做什么呢?

我们正在利用我们独特的能力提供实物资产,以满足个人投资者的特定需求。这并非我们希望去做并且希望会有需求的事情,这正是我们从计划管理人、顾问和财务顾问那里听到的反馈。

其次,我们正在积极开发专门为这些个人的需求量身定制的新产品,并且随着他们需求的演变和扩大,我们将持续这样做。

最后,我们已经拥有非常庞大且专注的团队,专注于这些终端客户,我们将继续扩大这些团队,以便我们能在这个市场中拥有与我们在机构市场中相同的领导地位。

因此,当哈德利(Hadley)上来介绍我们的五年计划时,我们相信个人投资者为我们五年基本业绩提供了一个上行空间,我们可能会实现显著的超额表现。

tips:立足今日,赢在未来

这些长期的、结构性的顺风将推动我们的业务,让我们在未来几十年里持续成功。

成果与路径

✓ 明确的商业计划和平台,旨在超越我们15%以上的长期目标

✓ 能够持续增加新增长杠杆的平台

✓ 实现约20%年化收益增长的路径——不仅是在未来五年,更是长远未来

总而言之,我们拥有一个能够在不到5年内实现规模翻倍的平台。但更重要的是,由于产品、合作伙伴关系和个人市场,我们持续以一致且可复制的方式为我们的业务增加新的增长杠杆。我们这样做的能力将使我们不仅在短期内,而且在更远的未来,都能超越我们的长期盈利目标。谢谢。

注:禅兄会在下一期解读布鲁克菲尔德资产管理公司的战略

【英文原文】

Last year when we gave this presentation, we explained how our platform was prepared to deliver and double in size over 5 years, matching more than the growth that had been delivered in the 25 years prior. This year, we intend to convey how we continuously add new additional growth levers to our business that will allow us to outperform our long-term earnings targets, not only in the near- term, but beyond.

Today, Brookfield Asset Management is the leading global alternative asset manager focused on real assets. We manage over a trillion dollars across five key verticals and we use a distinct owner operator approach to deliver attractive risk-adjusted returns across all our strategies and products and our platform our global reach our scale allows us to deliver on this performance. But it is our focus on critical assets and services, the backbone of the global economy that ensures that we are always positioned at the epicenter of the largest and most attractive investment themes around the world.

We execute on this business through an irreplaceable platform that is global in nature that allows us to raise and deploy capital in all of the world's most attractive markets. We use boots on the ground individuals that allow us to invest, operate, and raise funds across each of our strategies in every market around the world that we do business. And while that gives us a platform for success and growth, it also gives us an unparalleled global perspective to identify new trends around the world that we can position our business to capitalize on wherever and wherever they originate.

And as we continue to say and have been saying for years, the largest investment themes around the world today are those of digitalization, deglobalization, and decarbonization. Similar to what we said last year, these are attractive because the growth opportunities and the capital needs in each of these themes are so significant that they outstrip what is available from both public companies and from governments. And this creates a large attractive and growing opportunity for private capital. And that comment is more true today than it was last year. And it's far more true today than it was four or five years ago when we started talking about the 3Ds.

And we continue to believe that the largest and most attractive opportunities are for those who can operate at scale at the epicenter of one or more of these dynamics. And when you look at our platform, our position in the market and the themes that we are on the forefront of, we not only have a business that can double in less than 5 years, but can continue to add new growth levers over time on a repeatable basis. And that allows us to deliver up to 20% compound earnings on a year-over-year basis. Not just in the near term, but longer term as well.

And we can do this because of the leadership position that we already have that we continue to build from. And that leadership position is very difficult for anyone to replicate. It's been built over decades of delivering attractive risk adjusted returns at a scale and a consistency that few if any can match.

However, our focus on the backbone of the global economy and our continued focus on essential assets sometimes overshadows what we think is an underappreciated component of our business, which is we continue to work to preserve our leadership position by constantly evolving our platforms to take advantage of whatever the next large and attractive opportunity is. By doing this, we can continue to raise more capital from a wider spectrum of investors.

And similarly, on a continuous basis, we can generate proprietary deal flow. We can identify new trends. And we can continue to launch and scale new products and strategies that meet the needs of the market and of our clients. And as we think of what are the dynamics that will continue to add these new growth levers in the future, there are four. These are products, partnerships, performance, and individuals.

Let's start with products. Brookfield has a proven embedded capability to scale strategies that we already have, but we also have a unique and repetitive capability to develop, build, and launch one new strategies that meet the evolving market needs around the world and the demands of our clients, as well as products within those strategies that are uniquely tailored to the wide widening spectrum of investors that are now seeking to get exposure to alternatives.

And we can do this very efficiently and effectively because we already have large and leading platforms across the most important and fastest growing segments of the alternative sector. When we launch a new adjacent or complimentary product, it is not starting from scratch. It can leverage the existing global platform that already exists within that asset class. And this allows us to do this on a repeated basis with a high degree of success very quickly and at strong margins.

And Hadley's going to come up shortly to explain our five-year plan. And what she's going to show is that our largest products, our flagships, they continue to scale very quickly. But a growing portion of our future growth is now coming from complimentary and ancillary products. And this is not new.

This is part of an ongoing process that has been happening for more than a decade where we are systematically looking to offer the full suite of products and services across debt, equity and structured solutions across every vertical we have for every investor type we look to service. And this is already showing up in our results. Over 70% of our fee revenue today comes from products and strategies that have been launched in the last decade. And we expect those strategies to make up about two-thirds of our fundraising in our 5-year plan. So what are some tangible examples of this?

Over the last 10 years, we've built a credit franchise that today represents 30% of our global revenues and is growing at more than 20% a year. And we've done this solely by not trying to be all things to all people, but rather leveraging the existing leadership positions we already have. We have a leading real asset finance business that leverages Brookfield's historical leadership in real assets. We have a leading opportunistic credit franchise leveraging Oaktree's historical leadership position. And we have one of the largest and fastest growing asset-backed finance franchises leveraging the leadership of Castlelake, Primary Wave and our other partner managers.

But it doesn't always take 10 years. Sometimes it can be a lot faster. In 2021, we launched our first ever energy transition product leveraging our multi-decade track record within renewables. In less than five years, we now have a franchise that produces over $400 million a year. And every product within that strategy is market leading in terms of its scale. And we were able to do that by simply leveraging the capabilities, platform, and knowledge that already existed within Brookfield.

And this is not a one-hit wonder. We are already seeing history repeat itself. Today there is a significant market opportunity to fund the growth of AI infrastructure both in this country and around the world. And that strategy is going to require a unique pool of capital that is dedicated to the investment profiles within that theme. And given our leadership in digital infrastructure, our relationships with the hyperscalers, our experience in advanced manufacturing, and our leading power business around the world across traditional renewables and nuclear, we feel we are placed to launch a market-leading AI infrastructure franchise and you will hear more about that on the panel later today.

So let's move to partnerships. Brookfield is unique. Our owner operator approach, the alignment that comes by investing significant Brookfield capital alongside our LP partners and our owner op and the dedicated industry specific knowledge and experience. This differentiates us and makes us a sought-after counterparty for the largest and most important organizations in the world for their strategic and growth initiatives.

And our ability to provide large-scale flexible capital solutions and to deliver transaction certainty provides us a large and attractive proprietary deal flow pipeline where we don't need to compete on cost of capital and we are able to offer this interactive deployment to our clients through our private funds. And again, this is not theoretical.

Simply from bilateral partnerships that we have announced in 2025, we have $40 billion of go forward deployment opportunities. And that's on top of partnerships we'd announced before this year where we're already and continuously deploying capital. And obviously we can use this attractive deal flow to scale up some of our existing strategies, but we can also use it to launch new strategies. The way our Barclays partnership is helping us launch our financial infrastructure fund or our sovereign AI partnerships are helping us launch our AI infrastructure platform.

And these partnerships go beyond just funding arrangements. By working closely with the largest and most sophisticated organizations around the world, we consistently and continuously find more ways to work together. We can be their operating partner. They can be a tenant in our buildings. We can manage their pension for them. They can be an offtaker of our assets. We can pursue new investments together in the future. These partnerships are only going to scale with us as our business grows.

And we are able to launch these part execute these partnerships and we are able to launch these products because of what is the bedrock of our business which is our long track record of delivering very attractive risk-adjusted returns. Our value-oriented approach and our focus on essential durable assets with long-term cash flows provides a platform that can perform across the market cycle and in a number of economic environments.

And this is particularly important today as public markets become more volatile and as some of the new investors looking to get exposure to alternatives put an increasing focus on downside protection, consistency, and liquidity. And this is exactly what we offer. By continuing to invest in high-quality businesses, we can continue to expand into the largest and most attractive areas of real assets, but those that can continue to deliver the consistency and resiliency of returns that have defined our franchise for years. And this is particularly important for the individual investors we are looking to target and also insurance companies that are looking to get exposure to alternatives who want those premium returns but want to avoid illiquidity and volatility that has plagued some in the sector. And again, this shows up in our results across all of our major strategies and products. We have met or exceeded our returns on a long-term basis.

And this is something we will not compromise on as we continue to scale. Our investment discipline and our product innovation discipline will ensure that we continue to deliver this track record even as our platform expands.

But there's one more point to be made about insurance. And our focus on high-quality essential assets that produce cash flow has insulated Brookfield from some of the liquidity concerns that have plagued the alternative industry in recent periods by focusing on businesses that generate steady and growing cash flows and in particular by avoiding investments that require high valuations on exit in order to generate returns. We have more options to either up-finance or monetize businesses to provide LPS distributions even if market conditions are not ideal.

Take real estate and private equity as an example. Two sectors of the market where the narrative of meager returns of capital is the strongest. In just 2025 or the 12 months, the most recent 12 months, we've actually had some of our most active periods of distributions reflecting the high quality of our portfolio. This differentiates our platform and will provide our next leg of growth particularly to the new investors looking to enter the alternatives market. Which brings us to our fourth growth lever, which is individuals.

There are more people across more investment types around investor types around the world today that are looking to get access to alternatives. And as this takes place, we see perhaps the largest growth opportunity for our platform since we launched our flagship funds. And not only are we prepared and well positioned to capitalize on this opportunity, we think we can take a disproportionate amount of share as this market grows over time.

And the background here is simple. For two decades, the alternatives market has grown as institutions have allocated more of their portfolio to alternatives. And the important thing to be reminded of here is this trend is not slowing down. Institutions continue to allocate more to alternatives and that alone could double the size of the alternative market over the next 10 years. And yes, while Brookfield is working to provide alternatives to a wider spectrum of investors, we continue to see significant growth from within institutions.

The dynamic of the largest institutional investors continuing to concentrate their capital in a smaller number of managers with the scale, track record and products to meet their global needs continues to benefit us because here we feel we are second to none. More specifically within Brookfield, there are still areas of the institutional market where we are only scratching the surface. Take Europe for example.

For years, it's been a market we deploy heavily into, but we've not raised as much capital there historically. We expect to raise three times as much capital in Europe this year than last year. We are still in the infancy of our family capital business. These are parts of our institutional platform that can grow not at 20 or 30% but two or three times a year going forward.

But as mentioned, everyone recognizes that we are in the early innings of one of the largest growth opportunities for the alternative sector and that is offering alternatives to the individual investor. This is your high net worth or retail investor. This is your annuity or insurance policy holder. This is your 401k or retirement market. And this market is exciting because not only is it larger than the institutional market on a global basis, but it has a smaller allocation to alternatives today. And over the next several many years, we expect that allocation to alternatives to increase dramatically due to changes in both regulation and investor demand.

And we are already on the forefront of this trend. Through Oaktree, our high net worth and retail platform, we are going to raise 10 billion dollars this year. That is more than 50% higher than last year. A momentum we expect to maintain as we launch more products that are specifically designed for that distribution channel. We're launching a private equity product currently and we will launch another credit product before the end of the year. Similarly, on the insurance and annuity side, we are already one of the largest providers of alternatives to the insurance and annuity space, not only through our service at BWS that continues to scale rapidly, but also by offering alternatives through SMAs to third-party insurance companies.

When we look at who will win in offering alternatives to individual investors, it is those who have size, brand and track record. And here we feel we are unmatched. But perhaps more importantly, these investors want those premium returns from alternatives, but they put a higher value on liquidity, consistency, and downside protection. And our focus on essential critical backbone of the global economy assets is perfectly matched to meet this market demand. No one is bigger in these areas of alternatives. And therefore, we feel we are best placed to offer these products to the individual market over time. And therefore, what are we doing today?

We are using our unique capabilities to provide real assets to meet the specific needs of individual investors. And this is not something we hope to do and we hope there will be demand for. This is exactly what we are hearing from the plan administrators, the consultants and the financial advisors.

Secondly, we are actively developing new products that are specifically tailored to the needs of these individuals and we will look to do that as their needs evolve and scale over time. And lastly, we already have very large and dedicated teams that are focused on these end customers and we will continue to scale these teams such that we can have a leadership in this market the same way we do in the institutional market.

And as such, when Hadley comes up to present our five-year plan, we believe the individual investor represents an upside to our base 5-year performance where we could materially outperform.

So in conclusion, we have a platform that can deliver that doubling of size in less than 5 years. But more importantly, due to products, partnerships, and the individual market, we continue to add new growth levers to our business on a consistent and repeatable basis. And our ability to do this will allow us to outperform our longtime earnings target, not only over the near- term, but beyond. Thank you.

注:禅兄会在下一期解读布鲁克菲尔德资产管理公司的战略

原创观点不易,希望各位能够多多支持!你的一个点赞、一次转发、随手分享,都是禅兄前进的最大动力~

日拱一卒,让我们一起慢慢变富!

朋友们记得“点赞+关注”