卡拉曼眼中的价值投资

(备注:下面节选了一些我早期翻译的《安全边际》中的一些句子,大家看看,可以体会一下股票投资与实业投资之间的差别。“股票代表生意的一部分”或者“将股票看作是生意的一部分”是巴菲特常说的格雷厄姆的三大贡献之一,上面的两种表述方式都说明股票就是股票,生意就是生意,“代表”(represent)或者“看作”(look·····as)都说明二者并非一回事,但却有联系。现在看,股票和生意的联系在于:1)股票的估值基础来自对其背后的生意的估值;2)股票就是生意。第二项为巴菲特在资金量大了以后的一种无奈选择,他多次表示自己最好成绩就是在自己年轻时,那时候资金量小,可以不停地卖出高估股票买入低估股票,而到了后期,资金量太大了,就不得不采用买入股票长期持有享受生意带来的利润或者直接收购生意。他的观察是如果他们每日的买入量达到当日成交量的20%,就会对股票价格有显著的影响,所以,对于手里有那么多资金的巴菲特,每日成交量在几十亿的股票已经很难成为自己的投资目标。他甚至多次表示,如果手里仅100万的资金,自己可以将年收益率搞到50%,他心里还是倾向于“套利式”价值投资。当然,你说我没有那么多时间研究更多的股票,或者,我自己的研究能力不行,那么,选择一些优质的股票,以大致合理的价格买入,然后长期持有,享受生意带来的利润,这样行不行?当然没问题,只不过收益率会低一些,但是,你不能说只有你这种做法才是价值投资,那种以价值为锚的低买高卖就是投机。)

1、价值投资并不神秘。过程也很简单:首先,确定股票的内在价值;然后,大幅打折买入。过程确实非常简单!最大的挑战在于保持必要的纪律和耐心,以便在股价非常便宜时买入而在股价不再便宜时卖出。这样,就可以有效避免多数市场参与者常见的短期收益狂躁症。

There is nothing esoteric about value investing. It is simply the process of determining the value underlying a security and then buying it at a considerable discount from that value. It is really that simple. The greatest challenge is maintaining the requisite patience and discipline to buy only when prices are attractive and to sell when they are not, avoiding the short-term performance frenzy that engulfs most market participants.

2、对于投资者,股票代表生意的一部分而债券代表对生意的借贷。投资者买卖股票的决定是以股票价格和价值的关系为依据。他们买卖股票是因为他们明白:自己清楚一些别人不知道、或不在乎、或倾向于忽视的事情。他们买股票,是因为与风险相比,股票提供的回报更诱人;他们卖股票,是因为与风险相比,股票提供的回报不再诱人。

To investors stocks represent fractional ownership of underlying businesses and bonds are loans to those businesses. Investors make buy and sell decisions on the basis of the current prices of securities compared with the perceived values of those securities. They transact when they think they know something that others don't know, don't care about, or prefer to ignore. They buy securities that appear to offer attractive return for the risk incurred and sell when the return no longer justifies the risk.

3、投资者希望至少从以下三个方面中的一个方面获得收益:从生意产生的现金流获利,这种收益最终会通过上涨的股价得以体现或通过分红回报投资者;当有人愿以更高的倍数买入股票时,投资者可以通过由倍数上升而推升的股票价格获利;通过缩小股票价格和生意价值之间的差距获利。(注意:这里就是股票投资与实业投资利润来源的最大区别,与实业相比,股票投资具备非常好的优势——有更多的利润来源。就 看 你 是 否 能 利用 得 好!)

Investors in a stock thus expect to profit in at least one of three possible ways: from free cash flow generated by the underlying business, which eventually will be reflected in a higher share price or distributed as dividends; from an increase in the multiple that investors are willing to pay for the underlying business as reflected in a higher share price; or by a narrowing of the gap between share price and underlying business value.

4、如果你将市场看作是投资机会的创造者(当价格偏离价值时),那么,你具备价值投资者的天赋;如果你让市场先生主导自己的投资,你最好找别人为你打理投资。

If you look to Mr. Market as a creator of investment opportunities (where price departs from underlying value), you have the makings of a value investor. If you insist on looking to Mr. Market for investment guidance, however, you are probably best advised to hire someone else to manage your money.

5、证券价格涨跌的基本原因有二:1)反映生意基本面(或投资者对基本面的认识); 2)反映短期供需关系。基本面变化的表现形式是多方面的,如,有些可通过公司层面体现出来,有些则通过宏观经济层面体现出来。

Security prices move up and down for two basic reasons: to reflect business reality (or investor perceptions of that reality) or to reflect short-term variations in supply and demand. Reality can change in a number of ways, some company-specific, others macroeconomic in nature.

6、巴菲特喜欢说:投资的第一条原则是“不要亏损”,第二条原则是“永远不要忘记第一条原则。”我也认为避免损失应该成为每一位投资者追求的首要目标。这并不是说投资者不能承担任何可能导致损失的风险,所谓“不要亏损”是指一个投资组合,在数年的时间长度内,不能出现较大幅度的本金损失。

Warren Buffett likes to say that the first rule of investing is "Don't lose money," and the second rule is, "Never forget the first rule." I too believe that avoiding loss should be the primary goal of every investor. This does not mean that investors should never incur the risk of any loss at all. Rather "don't lose money" means that over several years an investment portfolio should not be exposed to appreciable loss of principal.

7、投资者无法通过努力思考和投入大量的时间和精力来使自己的投资获得高收益。一个投资者能够做的所有事情就是始终自律且严格要求自己。时间久了,利润自然产生。

An investor cannot decide to think harder or put in overtime in order to achieve a higher return. All an investor can do is follow a consistently disciplined and rigorous approach; over time the returns will come.

8、作为价值投资者,意味着你要站在“羊群”之外,挑战传统智慧,逆势而为。这是一个孤独者的旅程!在持续时间较长的牛市期间,价值投资者的业绩与其他投资者的业绩以及整个市场表现相比可能会比较差,有时甚至会很差。但是,将时间线拉得更长以后看,价值投资会非常成功。以至于即便有也是极少数价值投资者会半途而废。

Being a value investor usually means standing apart from the crowd, challenging conventional wisdom, and opposing the prevailing investment winds. It can be a very lonely undertaking. A value investor may experience poor, even horrendous, performance compared with that of other investors or the market as a whole during prolonged periods of market overvaluation. Yet over the long run the value approach works so successfully that few, if any, advocates of the philosophy ever abandon it.

9、投资者不但要知道自己的投资是否被低估,还要知道为什么被低估。知道你持有的原因和你要卖出的原因非常关键。

Investors should pay attention not only to whether but also to why current holdings are undervalued. It is critical to know why you have made an investment and to sell when the reason for owning it no longer applies.

10、当市场整体走强时,上升潮将多数的“船只”浮起升高。此时,实现收益变得很容易;犯错误的后果也不严重;高风险看起来也能获得好回报;回头看看自己在这一时期的投资也会觉得一切都很合理。但正如有话说得好:“只有潮水退去以后,你才知道谁在裸泳。”

When the overall market is strong, the rising tide lifts most ships. Profitable investments are easy to come by, mistakes are not costly, and high risks seem to payoff, making them seem reasonable in retrospect. As the saying goes, "You can't tell who's swimming naked till the tide goes out."

11、从某种意义上讲,价值投资是一种在股票价格和价值间的大型套利行为。套利是利用不同市场间价格差异的一种获利行为。

In a sense, value investing is a large-scale arbitrage between security prices and underlying business value. Arbitrage is a means of exploiting price differentials between markets.

12、然而,与经典套利不同,价值投资并非没有风险;利润既不是即时的,也不是确定的。

Unlike classic arbitrage, however, value investing is not risk-free; profits are neither instantaneous nor certain.

13、很多投资者坚持要给自己的投资一个精确的价值,这是在一个低精度领域寻找高精确结果,但是生意的价值很难精确确定。毕竟,报告里的账面价值、收益、现金流等,都仅是会计师在严格的标准和实践约束下的最佳观点,而这些标准和约束的设计,也仅是为了能够尽可能地与价值保持一致关系,但不能够完全反应其真实价值。

Many investors insist on affixing exact values to their investments, seeking precision in an imprecise world, but business value cannot be precisely determined. Reported book value, earnings, and cash flow are, after all, only the best guesses of accountants who follow a fairly strict set of standards and practices designed more to achieve conformity than to reflect economic value.

14、尽管知道如何评价企业价值对于成功投资非常关键,但投资过程中,最重要的、首先要做的事也许是知道到哪里去寻找机会。

While knowing how to value businesses is essential for investment success, the first and perhaps most important step in the investment process is knowing where to look for opportunities.

15、好的投资机会并不多,也很珍贵,需要努力去发现。它们不会轻易从我们的窗前飞过,也难以在贫瘠的土壤里生根发芽。尽管华尔街和计算机程序偶尔也可以提供一些投资方向,但投资者不要奢望毫不费力地从华尔街的推荐里得到很多启示,不论他们多么强烈地推荐;也不要期望通过敲击一下键盘就可以发现好的投资标的,无论程序设计得多么完美。

Good investment ideas are rare and valuable things, which must be ferreted out assiduously. They do not fly in over the transom or materialize out of thin air. Investors cannot assume that good ideas will come effortlessly from scanning the recommendations of Wall Street analysts, no matter how highly regarded, or from punching up computers, no matter how cleverly programmed, although both can sometimes indicate interesting places to hunt.

16、价值投资者拥有一些特定的投资机会,大致可以分为三类:相对于清算价格,以折价出售证券时存在的机会;收益率机会;资产转换时存在的机会。

Value investing encompasses a number of specialized investment niches that can be divided into three categories: securities selling at a discount to breakup or liquidation value, rate-of-return situations, and asset-conversion opportunities.

17、价值投资天生就是逆趋势的。不被看好的股票才能被低估,热门股则很难被低估。从定义上看,“羊群们”买入的就是热门的。热门股的股价被乐观预期推高,一般不会成为被遗忘的、好的投资目标。

Value investing by its very nature is contrarian. Out-of-favor securities may be undervalued; popular securities almost never are. What the herd is buying is, by definition, in favor. Securities in favor have already been bid up in price on the basis of optimistic expectations and are unlikely to represent good value that has been overlooked.

18、投资者可能发现成为一个“逆行者”非常困难,因为他们无法确定“逆行是否正确”或不知道“什么时候能够证明逆行是正确的”。由于逆“羊群”而为,逆行者往往在初始阶段会被认为是“错误的”,而且可能会发生账面亏损,而此时,“羊群”内的那些人却往往被证明是“正确的”。逆行者不光是暂时被证明是“错误”的,而且在很长一段时期也被证明是“错误”的,因为市场趋势可能会在较长时期内击败基本面。

Investors may find it difficult to act as contrarians for they can never be certain whether or when they will be proven correct. Since they are acting against the crowd, contrarians are almost always initially wrong and likely for a time to suffer paper losses. By contrast, members of the herd are nearly always right for a period. Not only are contrarians initially wrong, they may be wrong more often and for longer periods than others because market trends can continue long past any limits warranted by underlying value.

19、在收集企业完美信息过程中,投资者经常漏掉一个重要的信息源。在很多情况下,外人永远不会比企业管理人员更了解企业。因此,当企业内部人员买入自己企业的股票时,投资者也可以跟着做。

(备注:让巴菲特感到比较遗憾的一件事是:没有跟着Tesco的管理层一起卖掉Tesco的股票,导致7亿美元以上的损失。)

In their search for complete information on businesses, investors often overlook one very important clue. In most instances no one understands a business and its prospects better than the management. Therefore investors should be encouraged when corporate insiders invest their own money alongside that of shareholders by purchasing stock in the open market.

20、实现内在价值回归的催化剂,有些来自公司经理层或董事会。例如,卖掉公司或清算决定就来自公司内部。其它的一些催化剂来自外部,而且经常是来自于公司投票权的争夺。

Some catalysts for the realization of underlying value exist at the discretion of a company's management and board of directors. The decision to sell out or liquidate, for example, is made internally. Other catalysts are external and often relate to the voting control of a company's stock.

21、不同催化剂的成效各不相同,有计划地资产出售或资产清算,可以充分实现内在价值。而分拆、回购、资产重组和重大资产出售一般可以部分实现内在价值。

Catalysts vary in their potency. The orderly sale or liquidation of a business leads to total value realization. Corporate spinoffs, share buybacks, recapitalizations, and major asset sales usually bring about only partial value realization.

22、以低于内在价值的价格买股票是价值投资的独有特点,而通过催化剂,部分或全部兑现内在价值则是实现收益的重要手段。

While buying assets at a discount from underlying value is the defining characteristic of value investing, the partial or total realization of underlying value through a catalyst is an important means of generating profits.

————————————————————————

下面是investpedia对价值投资的定义,不如卡拉曼的那个好。卡拉曼:“价值投资是以低于价值的价格购买证券或资产的行为,即大家所熟知的以50美分的价格购买1美元资产,在这一点上,我们所处的时代与格雷厄姆和多德所处的时代并没有区别。”

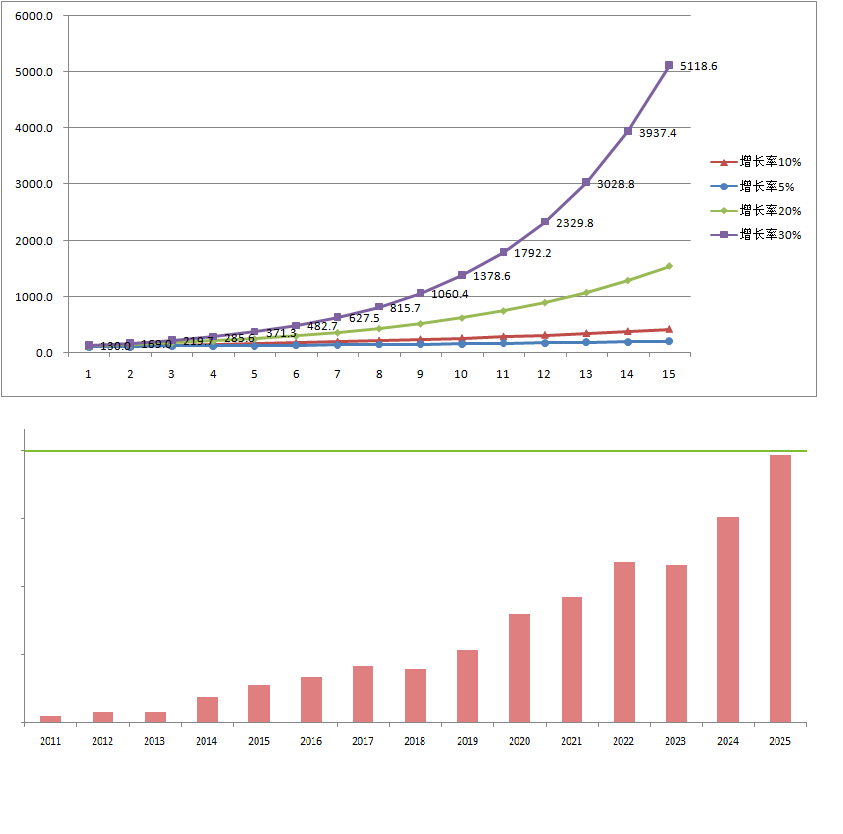

股票投资可以获得实业投资无法企及的成绩,下面第一张图是年化30%的理论曲线与三个“小矮人”(长期投资实业可能获得的收益率)的对比图,下图为实际案例,不如理论曲线平滑,但是看起来也还养眼。