波函数的坍缩

· 山东

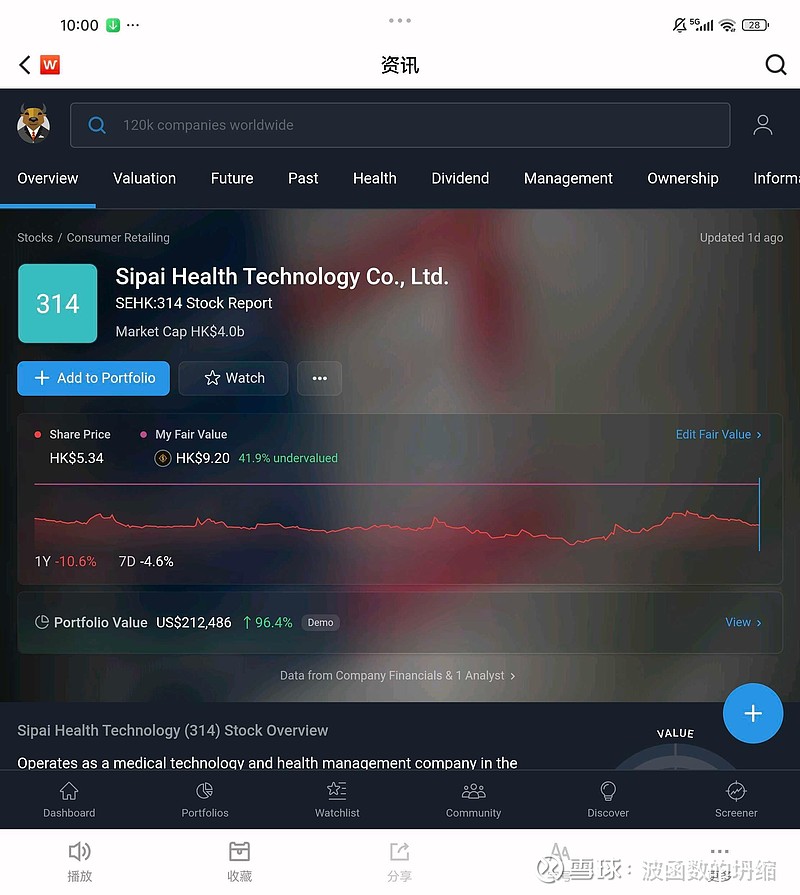

$思派健康(00314)$

We Think Sipai Health Technology (HKG:314) Can Easily Afford To Drive Business Growth

网页链接{Simply Wall St}(该机构介绍在本文末尾)

July 19, 2025

Just because a business does not make any money, does not mean that the stock will go down. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we'd take a look at whether Sipai Health Technology (HKG:314) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

翻译: 一家公司不赚钱,并不代表它的股价就一定会跌。比如,亚马逊(Amazon.com)在上市后的很多年里都处于亏损状态,但如果你从 1999 年买入并一直持有,到现在早已赚得盆满钵满。不过,只有傻瓜才会忽视“亏损企业可能很快烧光现金”这一风险。正因如此,我们想看看思派健康科技(Sipai Health Technology,港股代码:314)的股东是否需要担心公司的现金消耗。本文把“现金消耗”定义为年度负自由现金流——即企业每年为了支持增长而净流出的现金。首先,我们会把它的现金消耗与账面现金储备进行比较,从而算出公司的“现金跑道”(现金还能撑多久)。

When Might Sipai Health Technology Run Out Of Money?

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Sipai Health Technology last reported its December 2024 balance sheet in April 2025, it had zero debt and cash worth CN¥920m. Importantly, its cash burn was CN¥70m over the trailing twelve months. That means it had a cash runway of very many years as of December 2024. Notably, however, the one analyst we see covering the stock thinks that Sipai Health Technology will break even (at a free cash flow level) before then. If that happens, then the length of its cash runway, today, would become a moot point. You can see how its cash balance has changed over time in the image below.

翻译: 思派健康科技什么时候会“现金见底”?

“现金跑道”指的是:如果公司继续以当前的烧钱速度支出,账面现金还能撑多久。根据思派健康在 2025 年 4 月公布的 2024 年 12 月资产负债表,公司没有任何债务,现金余额约 9.2 亿元人民币;而过去 12 个月的现金消耗仅为 7,000 万元。这意味着,截至 2024 年底,其现金跑道长达 十余年。更关键的是,目前覆盖该股的唯一一位分析师预计,思派健康将在这一时点之前率先实现 自由现金流转正。若预测成真,那么今天再讨论“现金跑道”就变得毫无意义。下图(附图一)展示了其现金余额随时间的变化。

How Well Is Sipai Health Technology Growing?

We reckon the fact that Sipai Health Technology managed to shrink its cash burn by 50% over the last year is rather encouraging. But the revenue dip of 3.1% in the same period was a bit concerning. On balance, we'd say the company is improving over time. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at 网页链接{our analyst forecasts for the company}.

翻译: 思派健康科技的成长情况如何?

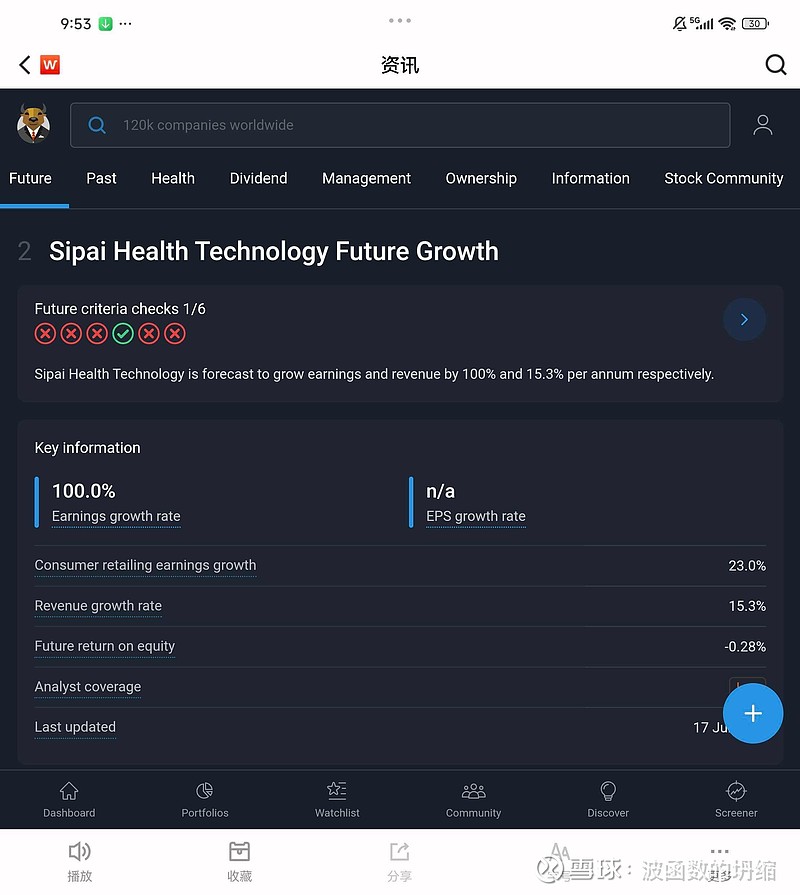

过去一年,公司将现金消耗削减了 50%,这一表现相当令人鼓舞;但同期收入下滑 3.1%,稍显担忧。综合来看,我们认为公司整体正在逐步改善。尽管回顾过去有其价值,但未来才最关键。因此,查看我们对该公司的分析师预测将更具意义:见附图2

![[献花花] [献花花]](//assets.imedao.com/ugc/images/face_regular/v1/emoji_38_flower.png?v=1)

![[火箭] [火箭]](//assets.imedao.com/ugc/images/face_regular/v1/emoji_83_rocket.png?v=1)

![[色] [色]](//assets.imedao.com/ugc/images/face_regular/v1/emoji_50.png?v=1)

![[心心] [心心]](//assets.imedao.com/ugc/images/face_regular/v1/emoji_39_heart.png?v=1)

![[涨] [涨]](//assets.imedao.com/ugc/images/face_regular/v1/emoji_56_increase.png?v=1)

![[梭哈] [梭哈]](//assets.imedao.com/ugc/images/face_regular/v1/emoji_51_allin.png?v=1) 附图2那句话及翻译: Sipai Health Technology is forecast to grow earnings and revenue by 100% and 15.3% per annum respectively

附图2那句话及翻译: Sipai Health Technology is forecast to grow earnings and revenue by 100% and 15.3% per annum respectively

思派健康科技的盈利预计将每年增长 100%,收入预计将每年增长 15.3%。

Can Sipai Health Technology Raise More Cash Easily?

There's no doubt Sipai Health Technology seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Sipai Health Technology has a market capitalisation of CN¥4.4b and burnt through CN¥70m last year, which is 1.6% of the company's market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

翻译: 思派健康科技再融资是否轻松?

在现金消耗管理方面,思派健康显然处于相当有利的位置;但即便只是假设,也值得问一句:如果公司需要更多资金来推动增长,它能否轻松筹集?一般而言,上市公司可通过增发新股或举债来融资。最常见的方式是向市场增发股份以换取现金。我们可以把公司一年的现金消耗与其市值进行对比,从而大致估算需要增发多少股份才能覆盖当年的运营。

思派健康目前市值约 44 亿元人民币,过去一年现金消耗仅为 7,000 万元,占市值的 1.6%。因此,公司几乎肯定可以通过少量借款继续支撑一年,或仅通过发行极少量的新股即可轻松筹得所需资金。

Is Sipai Health Technology's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way Sipai Health Technology is burning through its cash. For example, we think its cash runway suggests that the company is on a good path. Although its falling revenue does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. There's no doubt that shareholders can take a lot of heart from the fact that at least one analyst is forecasting it will reach breakeven before too long. After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. Taking an in-depth view of risks, we've identified 网页链接{1 warning sign for Sipai Health Technology} that you should be aware of before investing.翻译: 思派健康科技的现金消耗值得担忧吗?

相信您已经看出来了,我们对其现金消耗速度相对放心。例如,从“现金跑道”来看,公司显然走在一条健康的道路上。尽管营收下滑确实让人稍作停顿,但本文讨论的其他指标整体呈现出正面图景。毫无疑问,至少有一位分析师预计公司不久后将实现盈亏平衡,这对股东而言无疑是一剂强心针。综合本文考量的一系列因素后,我们对它的现金消耗相当放松,因为公司似乎有能力继续为自身增长提供资金。附图3。

文章完,以下是研究机构介绍。

~~~~~~~~~~~~~~~~勤奋的我的分割线~~~~~~~~~~~~~~~~~~~

simply wall st介绍

关于我们 – Simply Wall St 新闻

在全球范围内搜索任何股票我们的编辑团队

在 Simply Wall St,我们热爱股票投资。我们的多元化分析师团队拥有多年经验,并对分析企业有着深厚热情,致力于理解优秀企业成功的秘诀。我们以全球领先的 Simply Wall St 平台为基础,并结合外部数据源,进行深入分析,因此始终保持长期的客观视角,对每家公司一视同仁。我们对所分析的任何公司都没有任何利益激励,也不会针对用户具体投资标的持有任何既得利益。我们不提供买入或卖出建议。目前市场上大多数股票新闻报道并不能帮助投资者,反而促使他们陷入短期、情绪化思维,进而做出仓促且错误的决策。这很大程度上是因为广告驱动了绝大多数财经媒体网站的商业模式。在 Simply Wall St,我们努力帮助投资者忽略噪音,聚焦于真正重要的内容。因此,我们的内容大多具有教育性质,不使用行话,并通过可视化图表来解释洞察。团队还开发了一套专有的 AI 系统,为经常被忽视的中盘股和小盘股提供报道,同时对热门股票进行人工撰写分析。我们的公司分析方法遵循行业最佳实践,并以开源方式进行。我们使用 36 项检查清单来总结每家公司的核心基本面,并以“雪花图”(Snowflake)形式可视化。雪花图是一种强大工具,可以快速了解一家公司的特征、比较不同公司并发现投资机会。如果您对我们的报道有任何疑问,欢迎随时联系我们。我们的作者

• Michael Paige – 内容主管

• Kshitija Bhandaru – 股票分析师

• Sasha Jovanovic – 股票分析师

• Goran Damchevski – 股票分析师

• Richard Bowman – 股票分析师兼撰稿人

• Stjepan Kalinic – 股票分析师兼撰稿人

• Bailey Pemberton – 股票分析师

~~~~~~~~~~~~~~~~勤奋的我的分割线~~~~~~~~~~~~~~

$药明生物(02269)$ $康方生物(09926)$