2026-01-14【天然铀】路透社:Is the US uranium market about to go nuclear in 2026?

LITTLETON, Colorado, Jan 14 (Reuters) - Growing nuclear power generation alongside reactor construction is tightening the market for uranium - the main fuel used in nuclear power plants - and is setting the stage for a rally in uranium prices this year.

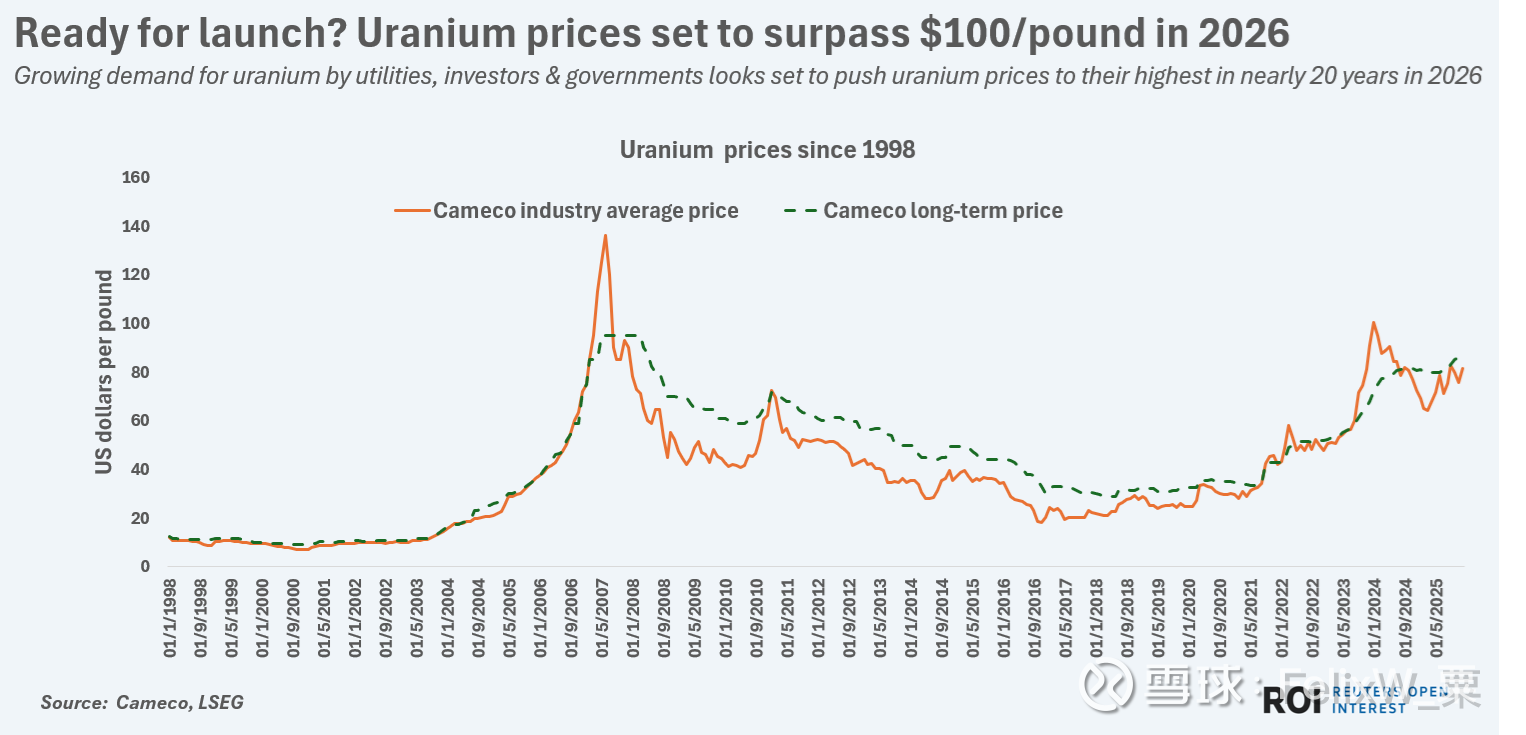

U.S. uranium industry spot prices ended 2025 at around $82 a pound in 2025, showed data from Canadian uranium miner Cameco,marking a roughly $10 or 12% rise from the end of 2024.

That rise compared to increases of well over 100% in the share prices of prominent uranium miners and fuel suppliers in 2025, which surged on policies by the U.S. government designed to revive nuclear power production.

Yet while equities tied to the nuclear supply chain look set to remain popular among investors, industry focus is turning to the state of the uranium market which is facing a widening structural deficit as consumption exceeds production.

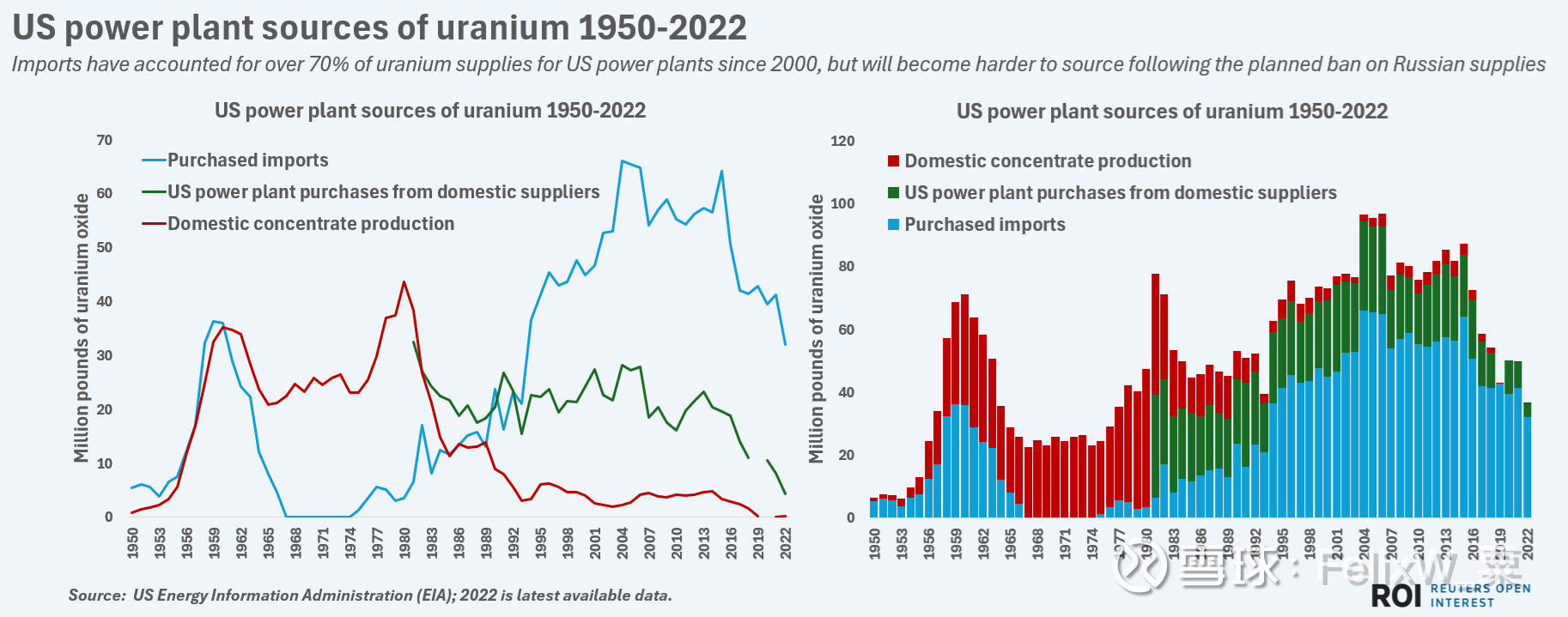

Surging demand for power due to an AI-fueled boom in data centers, alongside the construction of small modular reactors, is exacerbating that uranium shortfall, especially in the U.S. where mine supply hit historic lows in the past decade.

U.S. mine production of uranium is expanding again but is only set to be around 1 million pounds this year compared to U.S. annual consumption of over 50 million pounds.

This supply-demand mismatch is in turn subjecting U.S. uranium prices to upward pressure, which may intensify as 2026 rolls on.

Growing demand for uranium by utilities, investors & governments looks set to push uranium prices to their highest in nearly 20 years in 2026

While spot prices remain below $90 a pound, executives tracking discussions between mine suppliers and power generators have noted that long-term pricing contracts are nearer $100.

If deals are confirmed at or above the psychologically significant $100 - last consistently surpassed in 2007 - that could spark fresh momentum in spot market activity and help establish uranium as one of 2026's hottest markets.

STOCKS DRAWDOWN

In recent years, the U.S. uranium supply deficit was plugged by imports and inventories from the secondary market, which includes utility stockpiles, decommissioned warheads and leftover material at enrichment facilities.

But stepped-up purchases by utilities and government agencies have now drawn down those secondary supplies, while restrictions on future uranium imports from a belligerent Russia - which will be banned from 2028 - have narrowed the sources of imports.

Imports have accounted for over 70% of uranium supplies for US power plants since 2000, but will become harder to source following the planned ban on Russian supplies

This combination of lower stockpiles on the local secondary market and restrictions on imports has placed greater focus on the spot market and on any fresh but un-contracted output from uranium mines.

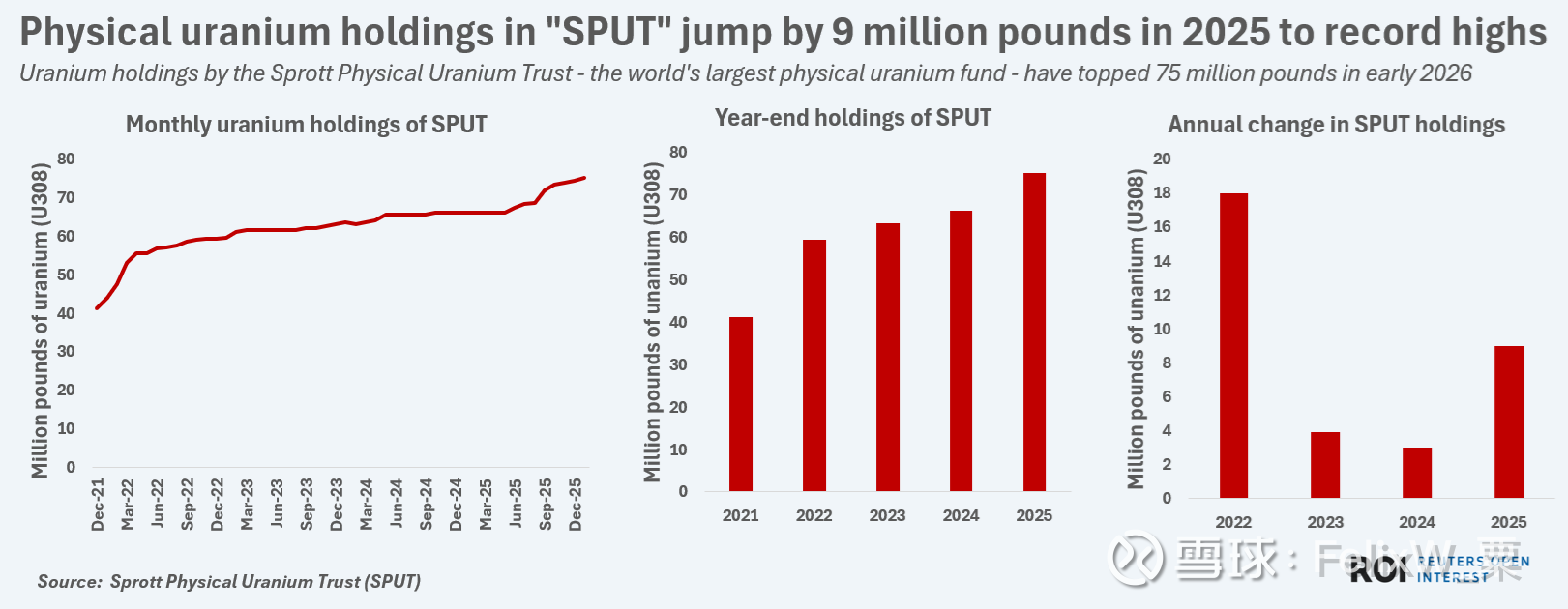

Increased uranium purchases by investors are further tightening the supply imbalance and are becoming another bullish driver of market sentiment.

Uranium holdings by the Sprott Physical Holdings Trust - the world's largest physical uranium fund - have topped 75 Mln pounds in early 2026

Uranium holdings by the Sprott Physical Uranium Trust (SPUT) - the world's largest fund that stockpiles physical uranium - increased by 9 million pounds to a record 72.5 million pounds in 2025, data from the trust showed.

As the global nuclear reactor fleet cranks up power production and new reactors begin operations, investor holdings of the main fuel needed by the nuclear sector look set to continue growing, adding further momentum to prices.

RECORD NUCLEAR GENERATION

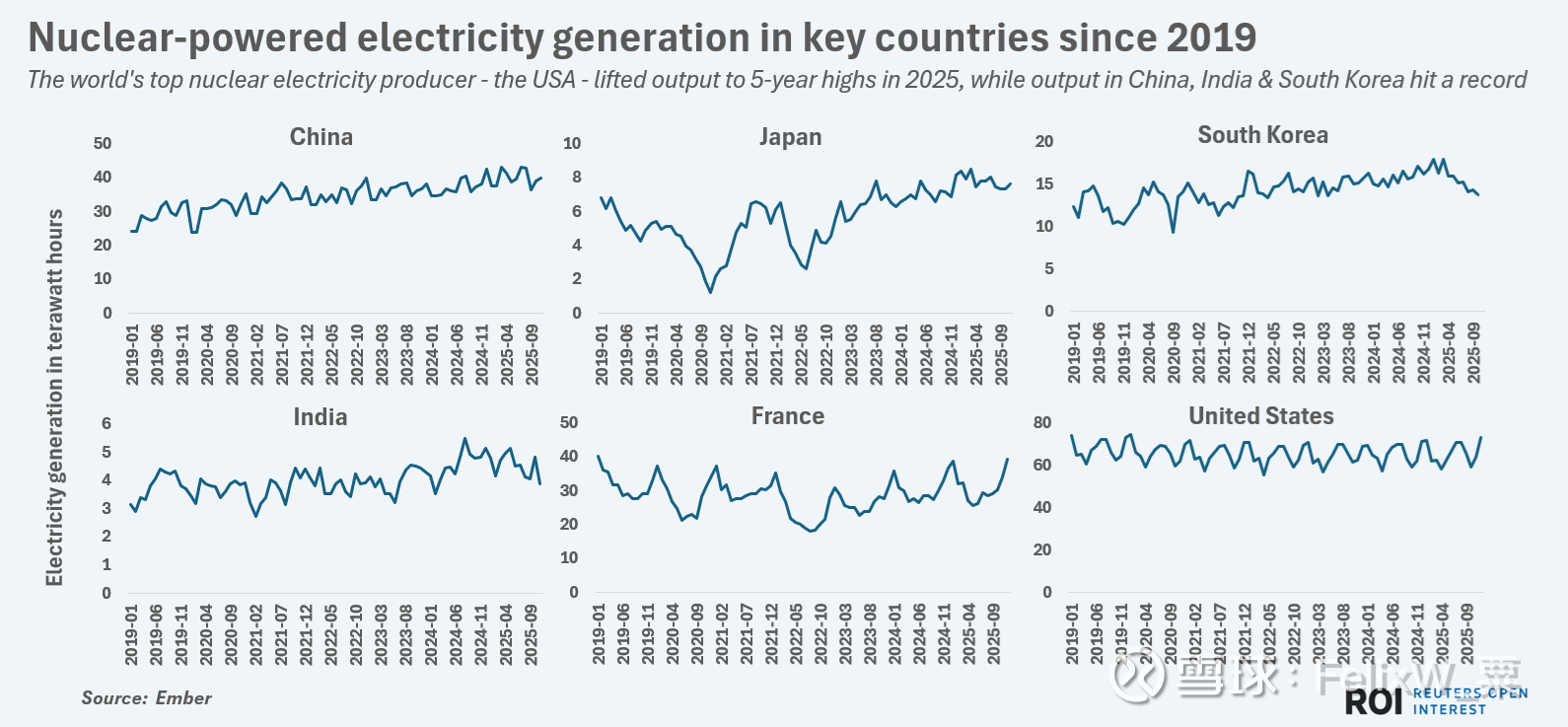

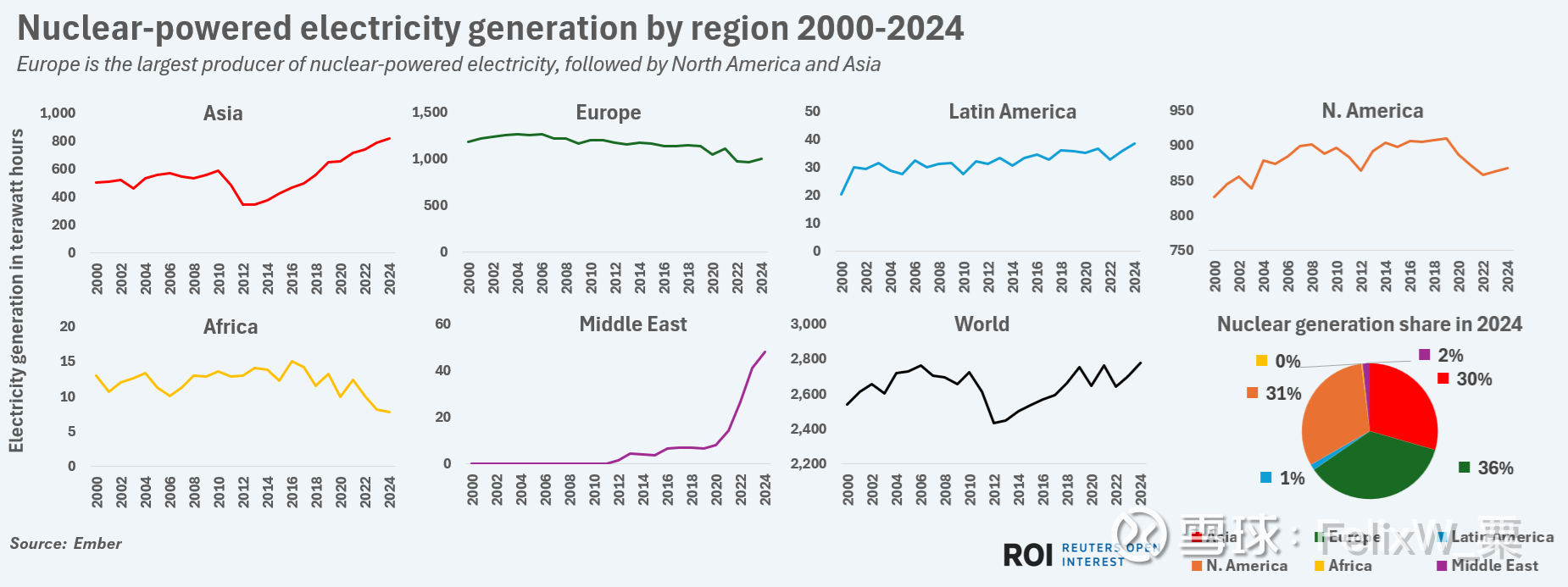

World output of nuclear-powered electricity likely hit a record in 2025, after generation in several major nuclear power systems hit all-time or multi-year highs.

The world's top nuclear electricity producer - the USA - lifted output to 5-year highs in 2025, while output in China, India & South Korea hit a record

Nuclear-powered electricity supplies in China, India, South Korea and France all rose to the highest levels in at least five years in 2025, data from energy think tank Ember showed.

Nuclear generation in Japan - which shuttered a majority of its nuclear fleet in the wake of the 2011 Fukushima meltdown - has also rebounded, and looks set to grow further in 2026 as the country restarts the world's largest reactor in Niigata prefecture.

Europe is the largest producer of nuclear-powered electricity, followed by North America and Asia

New nuclear reactors are also scheduled to begin operations in China, India, Turkey and the United States in 2026, which will further lift the nuclear sector's uranium appetite and help lift total nuclear power output to fresh record highs.

POWER PIPELINE

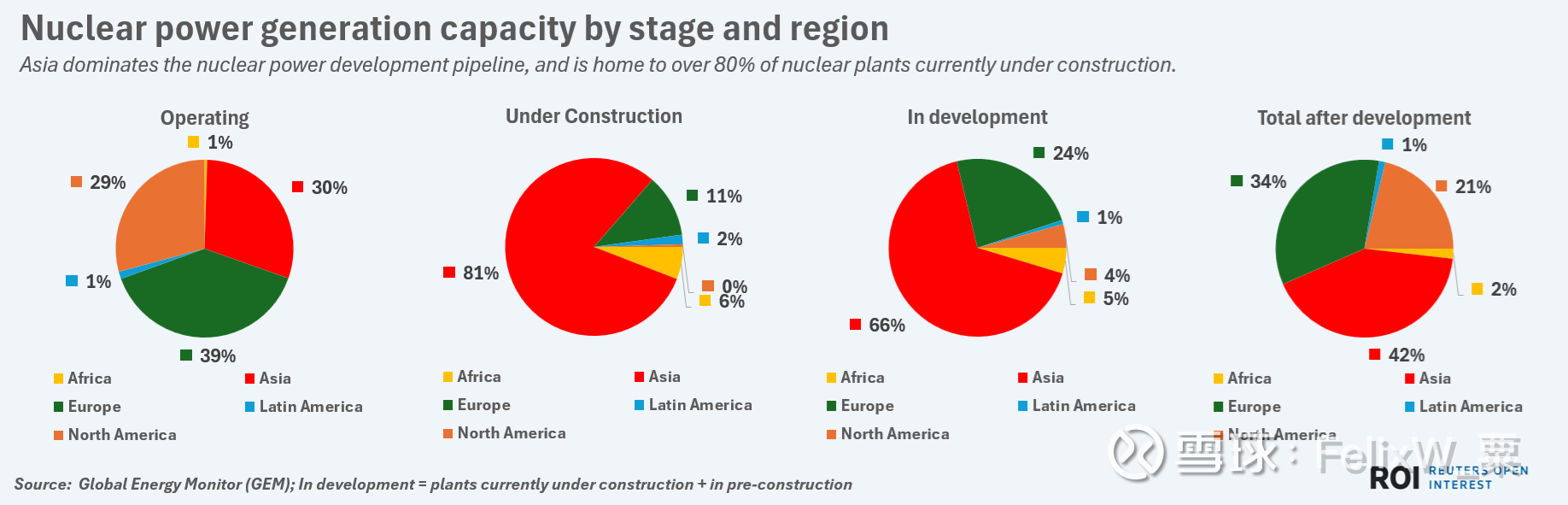

Europe accounts for a majority of the global nuclear power fleet, with 39% of all operating nuclear reactors located in the region.

Europe has around 157,000 megawatts (MW) of nuclear power generating capacity, showed data from Global Energy Monitor (GEM), with around 401,000 MW in place globally.

Asia has the next largest nuclear capacity footprint with around 120,000 MW, followed by North America's 117,000 MW.

Asia dominates the nuclear power development pipeline, and is home to over 80% of nuclear plants currently under construction.

However, Asia dominates the nuclear development pipeline, with 66,000 MW of reactors under construction in the region out of 82,000 MW being constructed globally.

Asia also accounts for two-thirds of nuclear power plants in so-called pre-construction, which is where sites have been selected and permits have been attained, but where crews have yet to break ground.

Around 107,000 MW are classified as being in pre-construction globally, with 60,000 MW in Asia, 36,000 MW in Europe, 8,000 MW in North America and 4,000 MW in Africa, GEM data showed.

Once the batch of plants that are under construction and in pre-construction are complete, Asia will emerge as the world's main nuclear hub, with around 246,000 MW of the global total of 590,000 MW of nuclear power generation capacity.

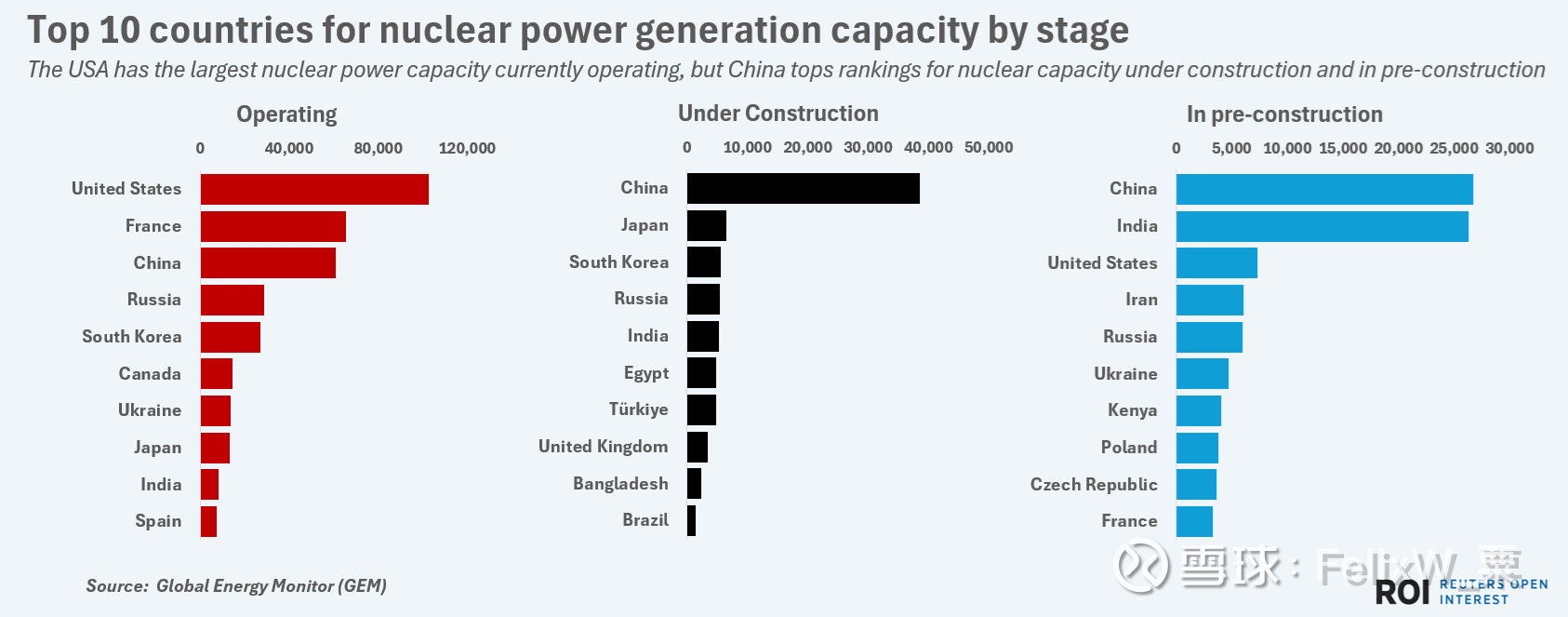

As with most areas of the energy sector, China tops country rankings in terms of nuclear capacity being built at around 65,000 MW, while India has the second-largest development pipeline at 32,000 MW.

Nuclear power capacity by stage in top 20 countries by current nuclear generation capacity

The United States has around 8,000 MW of nuclear capacity in the development queue which, when complete, would mark a roughly 7% rise in total U.S. installed nuclear generation capacity.

However, given aggressive policy backing to speed up growth in the U.S. nuclear sector, it is likely that additional capacity plans will emerge in the years ahead.

That in turn will only tighten the country's uranium supply situation and will likely keep uranium prices prone to bouts of strength for the foreseeable future.

#今日话题# #核电概念股# #天然铀# $中广核矿业(01164)$ $Cameco Corp(CCJ)$ $铀矿ETF-Global X(URA)$