重读《巴菲特致股东的信》系列-1978年(一)

1978

To the Shareholders of Berkshire Hathaway Inc.:

First, a few words about accounting. The merger with Diversified Retailing Company, Inc. at yearend adds two new complications in the presentation of our financial results. After the merger, our ownership of Blue Chip Stamps increased to approximately 58% and, therefore, the accounts of that company must be fully consolidated in the Balance Sheet and Statement of Earnings presentation of Berkshire. In previous reports, our share of the net earnings only of Blue Chip had been included as a single item on Berkshire’s Statement of Earnings, and there had been a similar one-line inclusion on our Balance Sheet of our share of their net assets.

首先,谈谈会计问题。 对 Diversified Retailing Company, Inc.的并购,给我们的财务报告增加了两个新的复杂因素。 其一, 合并后,我们对蓝筹印花公司的持股比例增至约 58%,因此,该公司的账目必须完全并入伯克希尔公司的资产负债表和收益表中。 在以前的报告中,我们在蓝筹公司净利润中所占的份额被作为一个单独的科目列入伯克希尔公司的收益表中,在我们的资产负债表中也同样以一个单独的科目列示了我们在其净资产中所占的份额。

This full consolidation of sales, expenses, receivables, inventories, debt, etc. produces an aggregation of figures from many diverse businesses - textiles, insurance, candy, newspapers, trading stamps - with dramatically different economic characteristics. In some of these your ownership is 100% but, in those businesses which are owned by Blue Chip but fully consolidated, your ownership as a Berkshire shareholder is only 58%. (Ownership by others of the balance of these businesses is accounted for by the large minority interest item on the liability side of the Balance Sheet.) Such a grouping of Balance Sheet and Earnings items - some wholly owned, some partly owned - tends to obscure economic reality more than illuminate it. In fact, it represents a form of presentation that we never prepare for internal use during the year and which is of no value to us in any management activities.

对销售收入、费用、应收账款、存货、债务等的全面合并,使得许多不同类型企业的数据汇总,如纺织、保险、糖果、报纸、邮票贸易等,这些企业的经济特征大相径庭。 在其中一些企业中,您作为伯克希尔股东的所有权是 100%,但在那些由蓝筹公司拥有且完全合并到公司报表的企业中,您的所有权仅为 58%。 (在这些企业中,其他人对其余部分的所有权由资产负债表的大额少数股东权益项目表示)。 这种将资产负债表和收益项目--有些是全资所有,有些是部分所有—统一合并的做法往往会掩盖经济现实,而不是揭示经济现实。 事实上,这种列报方式我们从未在内部使用过,其也无法为我们的管理活动提供任何价值。

For that reason, throughout the report we provide much separate financial information and commentary on the various segments of the business to help you evaluate Berkshire’s performance and prospects. Much of this segmented information is mandated by SEC disclosure rules and covered in “Management’s Discussion” on pages 29 to 34. And in this letter we try to present to you a view of our various operating entities from the same perspective that we view them managerially.

因此,在整个报告中,我们提供了许多单独的“财务信息和对各业务部门的评论”,以帮助您评估伯克希尔的业绩和前景。 这些分部信息大部分是根据SEC的披露规则要求提供的,在第 29 页至第 34 页的 "管理层讨论 "中有所涉及。 在这封信中,我们试图以管理者的视角,向你们展示我们对各运营实体的看法。

A second complication arising from the merger is that the 1977 figures shown in this report are different from the 1977 figures shown in the report we mailed to you last year. Accounting convention requires that when two entities such as Diversified and Berkshire are merged, all financial data subsequently must be presented as if the companies had been merged at the time they were formed rather than just recently. So the enclosed financial statements, in effect, pretend that in 1977 (and earlier years) the Diversified-Berkshire merger already had taken place, even though the actual merger date was December 30, 1978. This shifting base makes comparative commentary confusing and, from time to time in our narrative report, we will talk of figures and performance for Berkshire shareholders as historically reported to you rather than as restated after the Diversified merger.

合并带来的第二个复杂问题是,本报告中的 1977 年数据与我们去年寄给你们的报告中的 1977 年数据不同。 会计惯例要求,当两个实体(如 Diversified 和伯克希尔公司)合并时,所有财务数据都必须按照公司成立时的合并情况列报,而不是按照最近的合并情况列报。 因此,所附的财务报表实际上是在假定 1977 年(以及更早的年份)Diversified 与伯克希尔公司已经合并,尽管实际合并日期是 1978 年 12 月 30 日。 这种基数的变化使得对财报的前后比较令人困惑,在我们的叙述性报告中,我们将不时谈论伯克希尔股东的数字和业绩,这些数字和业绩是历史上向你们报告的,而不是在对 Diversified 进行合并后追溯调整的结果。

心得:会计信息是投资分析的基础,前述四段内容从US GAAP准则对合并会计处理的要求出发,反思了会计信息在反映经济活动实质方面存在的局限性,指出”会计信息的可比性,会计信息对经济活动实质的反映能力“等对公司投资价值分析带来的扰动。这种思索,形象地反映了价值投资者站在所有者角度看到股票内在价值的特点,其不是简单地基于会计准则加工出来的会计信息,而机械地进行有关”总额变动、比率变化“等计算,在此基础上做出估值决策。而是站在所有者视角,也即站在经营管理者视角,从经济活动最本质的视角出发,去思考根据现行会计准则加工的会计信息的经济意义。的确,当上年公司对Blue Chip Stamps持股比例是36 1/2%时,公司根据会计准则要求,按照公司占Blue Chip Stamps的净资产的比例在资产负债表中确认长期股权投资的账面价值,同时按照公司占Blue Chip Stamps的净利润的比例在利润表中确认投资收益。而当今年公司对对Blue Chip Stamps持股比例升至58%时,便达到了会计准则规定的实际控制的股权比例,依照会计准则对非同一控制企业合并的要求,公司需要将Blue Chip Stamps资产负债表的各个会计科目按照购买日的公允价值全额合并到公司合并资产负债表中,并将支付对价与净资产公允价值之间的差额确认为商誉,以后年度对其进行减值测试;此外,再将合并当年购买日之后的收入、费用全额合并至公司报表中,后续年度还需要通过调整的资产价值进行折旧产生的差额调整被合并的费用。由此可见,公司对Blue Chip Stamps增加约12%的股权,导致并购方和被并购方公司的资产、负债、权益、收入、费用的各个科目加总,虽然公司只持有Blue Chip Stamps58%的股权,而不是100%,但是合并报表却不加区分地将各个科目其全额合并进来,然后只是通过少数股东权益和少数股东净利润对最终结果进行调整。这种会计计量方式会带来的一种极端情况便是,部分公司可能会通过搭建复杂且链条冗长的金字塔型资本结构,实现以极少的自有资本撬动和控制远超其自身规模的庞大资产和负债,形成巨大的杠杆效应。而在这种资本结构下,一旦经营变差,顶层母公司有限资本根本无力应对整个体系累积的风险,进而导致整个体系很容易瞬时崩塌。因此,在进行报表分析时,我们应该意识到全资和非全资子公司同样会计处理背后隐含的不同经济意义。此外,即使都是全资子公司,也应注意区分不同经济特征的业务板块创造的收入和利润情况,借助全面的横纵向比较,分析其质量如何,而不是根据简单粗暴的合并结果判断整个企业集团的经营效率高低。另外,回到会计信息可比性的问题上,从经济活动实质角度看,虽然公司对Blue Chip Stamps的持股比例增加了,但其仍然是公司非全资持有的公司,采用合并追溯调整前的历史报表数据进行财务分析,更能反映经济活动的实质。

With that preamble it can be stated that, with or without restated figures, 1978 was a good year. Operating earnings, exclusive of capital gains, at 19.4% of beginning shareholders’ investment were within a fraction of our 1972 record. While we believe it is improper to include capital gains or losses in evaluating the performance of a single year, they are an important component of the longer term record. Because of such gains, Berkshire’s long-term growth in equity per share has been greater than would be indicated by compounding the returns from operating earnings that we have reported annually.

有了这个前言,我们可以说,无论是否对财务数据进行追溯调整,1978 年都是一个业绩很好的年份。 不包括资本利得在内的经营收益占期初股东投资的 19.4%(1977年是19%,预期是不超过19%),与我们 1972 年的记录相差无几。 虽然我们认为在评估一年的业绩时将资本利得包括在内是不恰当的,但它们是长期记录的一个重要组成部分。 由于这些收益,伯克希尔公司每股净资产的长期增长超过了我们每年报告的运营收益的复合回报。

For example, over the last three years - generally a bonanza period for the insurance industry, our largest profit producer - Berkshire’s per share net worth virtually has doubled, thereby compounding at about 25% annually through a combination of good operating earnings and fairly substantial capital gains. Neither this 25% equity gain from all sources nor the 19.4% equity gain from operating earnings in 1978 is sustainable. The insurance cycle has turned downward in 1979, and it is almost certain that operating earnings measured by return on equity will fall this year. However, operating earnings measured in dollars are likely to increase on the much larger shareholders’ equity now employed in the business.

例如,在过去的三年里——我们最大的利润来源“保险板块”,其行业忽然迎来了普遍的繁荣——通过良好的经营收益和相当可观的潜在资本收益,伯克希尔公司的每股净资产几乎翻了一番,每年的复合增长率约为 25%。 不过,无论25%的权益综合收益复合增速,还是 1978 年19.4% 期初股本经营收益率,都是不可持续的。 保险周期在 1979 年转为下行,因此几乎可以肯定,以期初股本回报率衡量的经营收益率今年将会下降。 然而,在如今更大权益规模下,以美元计算的经营收益总额可能会增加。

In contrast to this cautious view about near term return from operations, we are optimistic about prospects for long term return from major equity investments held by our insurance companies. We make no attempt to predict how security markets will behave; successfully forecasting short term stock price movements is something we think neither we nor anyone else can do. In the longer run, however, we feel that many of our major equity holdings are going to be worth considerably more money than we paid, and that investment gains will add significantly to the operating returns of the insurance group.

与我们对近期经营回报的谨慎态度不同,我们对保险公司持有的主要股票投资的长期回报前景持乐观态度。 我们并不试图预测证券市场的走势;我们认为,成功预测短期股价走势是我们和其他人都无法做到的事情。 但是,从长远来看,我们认为我们持有的许多主要股票的价值将大大超过我们所支付的成本,这些投资收益将大大增加保险集团的经营回报。

心得:在评估资本回报率时,巴菲特强调,短期着重看期初资本经营收益回报率,不考虑短期波动较大的资本利得产生的资本收益,长期则综合考虑经营收益和资本利得对资本回报率的影响。其背后隐含的考量是,短期,股票市场受市场情绪等非基本面因素扰动,价格偏离内在价值的倾向更强,股价持续性较差;长期,股价有向内在价值回归的倾向,股价有更坚实的支撑。因此,长短期视角中,衡量资本回报对资本利得的处理存在差异。价值投资者坚持长期主义,其中一个重要原因就是短期股票市场走势,受许多非基本面因素扰动,存在较高的随机性,任何人都无法对其进行有效预测,博弈短期股票走势是一种投机行为,投机长期来讲是个负期望的赌博游戏。而长期来看,股票市场价格通常会逐步收敛至基本面反映的内在价值,尤其是那些内在稳定性足够的生意,其基本面的长期趋势是可分析且可合理展望的,并且这种分析和展望的可靠性往往是足够的。因此,价值投资者会重视挖掘那些具备足够内在稳定性的企业,在价格合理的情况下买入,在极端市场行情中价格性价比极高的时候大量买入,并长期持有,等待价格向其内在价值回归,坐等收益实现。

Sources of Earnings

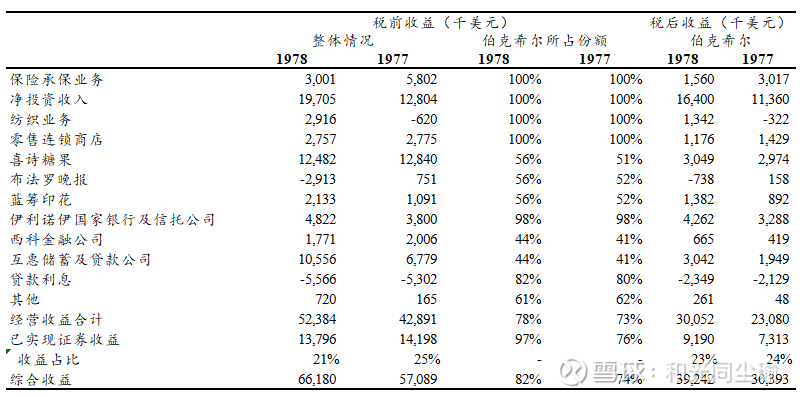

To give you a better picture of just where Berkshire’s earnings are produced, we show below a table which requires a little explanation. Berkshire owns close to 58% of Blue Chip which, in addition to 100% ownership of several businesses, owns 80% of Wesco Financial Corporation. Thus, Berkshire’s equity in Wesco’s earnings is about 46%. In aggregate, businesses that we control have about 7,000 full-time employees and generate revenues of over $500 million.

为了让大家更好地了解伯克希尔公司的盈利来源,我们展示下面这张表格做,并对其做一些解释。 伯克希尔公司拥有蓝筹印花公司近 58% 的股份,蓝筹印花公司除了全资拥有几家企业外,还拥有 Wesco 金融公司 80% 的股份。 因此,伯克希尔对 Wesco 盈余的份额约为 46%。 总而言之,我们控股的企业合计拥有约 7,000 名全职员工,收入超过 5 亿美元。

The table shows the overall earnings of each major operating category on a pre-tax basis (several of the businesses have low tax rates because of significant amounts of tax-exempt interest and dividend income), as well as the share of those earnings belonging to Berkshire both on a pre-tax and after-tax basis. Significant capital gains or losses attributable to any of the businesses are not shown in the operating earnings figure, but are aggregated on the “Realized Securities Gain” line at the bottom of the table. Because of various accounting and tax intricacies, the figures in the table should not be treated as holy writ, but rather viewed as close approximations of the 1977 and 1978 earnings contributions of our constituent businesses.

该表显示了各主要经营业务板块的税前总收益(其中几项业务的税率较低,因为其有大量免税利息和股息收入),以及属于伯克希尔公司的税前和税后收益情况。 归属于任何业务的重大资本利得不显示在运营收益数字中,而是汇总在表格底部的 "已实现证券收益 "一行。 由于会计和税务方面的各种复杂性,表中的数字不应被奉为圭臬,而应被视为我们各业务板块在 1977 年和 1978 年对公司整体盈利贡献的近似值。

Blue Chip and Wesco are public companies with reporting requirements of their own. Later in this report we are reproducing the narrative reports of the principal executives of both companies, describing their 1978 operations. Some of the figures they utilize will not match to the penny the ones we use in this report, again because of accounting and tax complexities. But their comments should be helpful to you in understanding the underlying economic characteristics of these important partly-owned businesses. A copy of the full annual report of either company will be mailed to any shareholder of Berkshire upon request to Mr. Robert H. Bird for Blue Chips Stamps, 5801 South Eastern Avenue, Los Angeles, California 90040, or to Mrs. Bette Deckard for Wesco Financial Corporation, 315 East Colorado Boulevard, Pasadena, California 91109.

Blue Chip 公司和 Wesco 公司都是上市公司,有自己的财务报告。 在本报告的后面部分,我们将转载这两家公司管理层讨论报告,介绍他们 1978 年的经营情况。 由于会计和税务方面的复杂性,他们使用的某些数字与我们在本报告中使用的数字不尽相同。 但是,他们的评论应该有助于您了解这些重要的非全资企业的基本经济特征。 如果伯克希尔公司的任何股东提出要求,我们将把这两家公司的完整年度报告邮寄给他们,邮寄地址分别是 Blue Chips Stamps 公司的 Robert H. Bird 先生(地址:5801 South Eastern Avenue, Los Angeles, California 90040)或 Wesco Financial Corporation 公司的 Bette Deckard 女士(地址:315 East Colorado Boulevard, Pasadena, California 91109)。

Textiles

Earnings of $1.3 million in 1978, while much improved from 1977, still represent a low return on the $17 million of capital employed in this business. Textile plant and equipment are on the books for a very small fraction of what it would cost to replace such equipment today. And, despite the age of the equipment, much of it is functionally similar to new equipment being installed by the industry. But despite this “bargain cost” of fixed assets, capital turnover is relatively low reflecting required high investment levels in receivables and inventory compared to sales. Slow capital turnover, coupled with low profit margins on sales, inevitably produces inadequate returns on capital. Obvious approaches to improved profit margins involve differentiation of product, lowered manufacturing costs through more efficient equipment or better utilization of people, redirection toward fabrics enjoying stronger market trends, etc. Our management is diligent in pursuing such objectives. The problem, of course, is that our competitors are just as diligently doing the same thing.

1978 年纺织板块的利润为 130 万美元,虽然比 1977 年有了很大的提高,但对该业务所投入的 1,700 万美元的资本来说,回报率仍然很低(资本回报率7.65% VS 当年整体资本回报率19.4%)。 纺织工厂和设备的账面价值只相当于今天更换这些设备所需的一小部分费用。 而且,尽管这些设备的使用年限已久,但其中大部分在功能上与该行业正在安装的新设备相似。 虽然固定资产的折旧成本低廉,但资本周转率却相对较低,这反映出与销售额相比,应收账款和存货的投资水平较高。 资本周转速度慢,叠加销售利润率低,必然导致资本回报不足。 提高利润率的明显方法包括产品差异化、通过更高效利用设备及人员来降低生产成本、转向市场趋势更强劲的面料等。 我们的管理层正在努力实现这些目标。 当然,问题是我们的竞争对手也在孜孜不倦地做着同样的事情。

The textile industry illustrates in textbook style how producers of relatively undifferentiated goods in capital intensive businesses must earn inadequate returns except under conditions of tight supply or real shortage. As long as excess productive capacity exists, prices tend to reflect direct operating costs rather than capital employed. Such a supply-excess condition appears likely to prevail most of the time in the textile industry, and our expectations are for profits of relatively modest amounts in relation to capital.

纺织业为我们阐明了一种教科书式的原理:除非在供应紧张或实际短缺的条件下,否则资本密集型企业中相对无差别商品的生产者必须赚取不足的回报。 只要生产能力过剩,价格就会反映直接运营成本,而不是投入的资本。 在纺织业的大部分时间里,这种供应过剩的情况似乎都可能存在,因此我们对利润的预期相对于资本而言是比较适中的。

We hope we don’t get into too many more businesses with such tough economic characteristics. But, as we have stated before: (1) our textile businesses are very important employers in their communities, (2) management has been straightforward in reporting on problems and energetic in attacking them, (3) labor has been cooperative and understanding in facing our common problems, and (4) the business should average modest cash returns relative to investment. As long as these conditions prevail - and we expect that they will - we intend to continue to support our textile business despite more attractive alternative uses for capital.

我们希望不要再涉足更多具有如此严峻经济特征的企业。 但是,正如我们以前所说的那样:(1)我们的纺织企业是所在社区非常重要的雇主;(2)管理层在报告问题时直言不讳,在解决问题时充满活力;(3)劳工在面对我们共同的问题时给予了合作和理解;(4)相对于投资而言,企业的平均现金回报率应该不高。 只要这些条件仍然存在,我们就打算继续支持我们的纺织业务。

心得:本部分对类似纺织业这类资本密集且产品差异化不足的制造业的资本回报特征,提出了一种非常有价值的洞见,认为这类行业只有在供应紧张或短缺时才有提价的机会,进而才可能获得足够的资本回报,只要产能过剩其价格就会直接反映经营成本,而非投资资本。对于纺织业而言,供应过剩长期存在,因此其资本回报长期不足。前几年国内资本市场高景气赛道“光伏、锂电行业”,在行业产能持续大幅扩张后,即使需求增速仍维持较高水平,但因行业供给严重过剩,近几年行业普遍进入经营维艰的状态,主要公司股价也随之巨幅缩水,不论是企业经营者还是资本市场投资者,资本回报率都明显不足,本质上这就是这类行业的基本经济特征决定的。国家目前已经出手引导行业“反内卷”,或逐渐能修复过低的资本回报率,但是当资本回报率回升至一定水平之后,企业或再次进行产能扩张。总之,这类行业的资本回报率或长期存在明显的周期性,或长期不足。因此,这类行业并不符合价值投资者的长期持有的投资偏好。

Insurance Underwriting

The number one contributor to Berkshire’s overall excellent results in 1978 was the segment of National Indemnity Company’s insurance operation run by Phil Liesche. On about $90 million of earned premiums, an underwriting profit of approximately $11 million was realized, a truly extraordinary achievement even against the background of excellent industry conditions. Under Phil’s leadership, with outstanding assistance by Roland Miller in Underwriting and Bill Lyons in Claims, this segment of National Indemnity (including National Fire and Marine Insurance Company, which operates as a running mate) had one of its best years in a long history of performances which, in aggregate, far outshine those of the industry. Present successes reflect credit not only upon present managers, but equally upon the business talents of Jack Ringwalt, founder of National Indemnity, whose operating philosophy remains etched upon the company.

伯克希尔公司 1978 年总体业绩优异的头号功臣是Phil Liesche经营的国家赔偿公司的保险业务。 在约 9000 万美元的保费收入中,实现了约 1100 万美元的承保利润(约12.2%承保利润率),即使在行业形势极佳的背景下,这也是一项非凡的成就。 在菲尔的领导下,在承保部Roland Miller和理赔部Bill Lyons的出色协助下,国家赔偿公司的这部分业务(包括作为竞争伙伴的国家火灾和海上保险公司)取得了历史上最好的成绩之一,总体业绩远远超过同行业。 目前的成功不仅归功于现任经理,也同样归功于国家赔偿公司创始人杰克-林华特(Jack Ringwalt)的商业才能,他的经营理念至今仍深深影响着公司。

Home and Automobile Insurance Company had its best year since John Seward stepped in and straightened things out in 1975. Its results are combined in this report with those of Phil Liesche’s operation under the insurance category entitled “Specialized Auto and General Liability”.

自 1975 年约John Seward上任并整顿公司以来,家庭与汽车保险公司迎来了最好的一年。 在本报告中,该公司的业绩与 Phil Liesche 的经营业绩合并在 "专业汽车和一般责任 "保险类别下。

Worker’s Compensation was a mixed bag in 1978. In its first year as a subsidiary, Cypress Insurance Company, managed by Milt Thornton, turned in outstanding results. The worker’s compensation line can cause large underwriting losses when rapid inflation interacts with changing social concepts, but Milt has a cautious and highly professional staff to cope with these problems. His performance in 1978 has reinforced our very good feelings about this purchase.

1978 年的工伤赔偿保险业务喜忧参半。 由Milt Thornton管理的赛普拉斯保险公司成为公司子公司的第一年就取得了出色的业绩。 当快速的通货膨胀与不断变化的社会观念相互作用时,工伤赔偿业务可能会产生巨大的承保损失,但Milt拥有一支谨慎且极其专业的员工队伍来应对这些问题。 他在 1978 年的表现增强了我们对这次收购的好感。

Frank DeNardo came with us in the spring of 1978 to straighten out National Indemnity’s California Worker’s Compensation business which, up to that point, had been a disaster. Frank has the experience and intellect needed to correct the major problems of the Los Angeles office. Our volume in this department now is running only about 25% of what it was eighteen months ago, and early indications are that Frank is making good progress.

Frank DeNardo于 1978 年春加入我们,负责整顿全国赔偿公司在加利福尼亚州的工伤赔偿业务——某种程度上,其过去实在糟糕透顶。 弗兰克拥有解决洛杉矶办事处主要问题所需的经验和智慧。 目前,我们在该分部的业务量仅为 18 个月前的 25%,初步迹象表明弗兰克正在取得良好进展。

George Young’s reinsurance department continues to produce very large sums for investment relative to premium volume, and thus gives us reasonably satisfactory overall results. However, underwriting results still are not what they should be and can be. It is very easy to fool yourself regarding underwriting results in reinsurance (particularly in casualty lines involving long delays in settlement), and we believe this situation prevails with many of our competitors. Unfortunately, self-delusion in company reserving almost always leads to inadequate industry rate levels. If major factors in the market don’t know their true costs, the competitive “fall-out” hits all - even those with adequate cost knowledge. George is quite willing to reduce volume significantly, if needed, to achieve satisfactory underwriting, and we have a great deal of confidence in the long term soundness of this business under his direction.

相对于保费收入,George Young领导的再保险部门继续产生巨额的投资收益,从而使我们的总体业绩相当令人满意。 然而,保费收入仍然不尽如人意。 在再保险的承保业务方面,很容易自欺欺人(特别是在涉及长期递延结算的意外险方面),我们相信这种情况在我们的许多竞争对手那里也普遍存在。 不幸的是,公司准备金的计提不充足几乎总是导致行业费率水平不足。 如果市场中的主要公司不了解自己的真实成本,那么这种错误竞争的 "后果 "最终会伤及所有人--即使是那些对成本有充分了解的人。 George非常愿意在必要时大幅减少承保量,以达到令人满意的承保利润率,在他的领导下,我们对这项业务的长期稳健发展充满信心。

The homestate operation was disappointing in 1978. Our unsatisfactory underwriting, even though partially explained by an unusual incidence of Midwestern storms, is particularly worrisome against the backdrop of very favorable industry results in the conventional lines written by our homestate group. We have confidence in John Ringwalt’s ability to correct this situation. The bright spot in the group was the performance of Kansas Fire and Casualty in its first full year of business. Under Floyd Taylor, this subsidiary got off to a truly remarkable start. Of course, it takes at least several years to evaluate underwriting results, but the early signs are encouraging and Floyd’s operation achieved the best loss ratio among the homestate companies in 1978.

1978年的州内承保业务令人失望。 尽管部分原因是中西部发生不寻常的风暴,但尤其令人担忧的是,在我们的州内承保的常规项目取得非常好的行业业绩的背景下,我们的承保情况并不令人满意。 我们相信John Ringwalt有能力纠正这种状况。 Kansas Fire and Casualty在其第一个完整业务年度的表现是该集团的亮点。 在 Floyd Taylor 的领导下,该子公司取得了令人瞩目的开端。 当然,评估承保结果至少需要几年的时间,但早期迹象令人鼓舞,因为Floyd的业务在1978年州内保险公司中取得了最低损失率。

Although some segments were disappointing, overall our insurance operation had an excellent year. But of course we should expect a good year when the industry is flying high, as in 1978. It is a virtual certainty that in 1979 the combined ratio (see definition on page 31) for the industry will move up at least a few points, perhaps enough to throw the industry as a whole into an underwriting loss position. For example, in the auto lines - by far the most important area for the industry and for us - CPI figures indicate rates overall were only 3% higher in January 1979 than a year ago. But the items that make up loss costs - auto repair and medical care costs - were up over 9%. How different than yearend 1976 when rates had advanced over 22% in the preceding twelve months, but costs were up 8%.

虽然有些部分令人失望,但总的来说,我们的保险业务在这一年里取得了优异的成绩。 当然,当保险业能像 1978 年这样高歌猛进时,我们也应该期待有一个好年景。 几乎可以肯定的是,1979 年保险业的综合比率(见第 31 页的定义)至少会上升几个点,也许这足以让整个保险业陷入承保亏损的泥潭。 例如,在汽车保险业--迄今为止对保险业和我们来说都是最重要的领域—CPI显示,1979 年 1 月的总体费率只比一年前高 3%。 但构成损失成本的项目--汽车修理和保养费用--却上涨了 9%以上。 这与1976年年底的情况恰恰相反,当时的费率在前12个月中上涨了22%,但成本却只上涨了8%。

Margins will remain steady only if rates rise as fast as costs. This assuredly will not be the case in 1979, and conditions probably will worsen in 1980. Our present thinking is that our underwriting performance relative to the industry will improve somewhat in 1979, but every other insurance management probably views its relative prospects with similar optimism - someone is going to be disappointed. Even if we do improve relative to others, we may well have a higher combined ratio and lower underwriting profits in 1979 than we achieved last year.

只有当费率与成本同步增长时,利润率才能保持稳定。 1979 年的情况肯定不会是这样,1980 年的情况可能会更糟。 我们目前的想法是,相对于同行业而言,我们的承保业绩在 1979 年会有所改善,但其他所有保险同行可能都会以类似的乐观态度来看待其相对前景--有人会失望的。 即使我们的承保业绩相对于其他公司有所改善,1979 年的综合比率和承保利润也很可能高于去年。

We continue to look for ways to expand our insurance operation. But your reaction to this intent should not be unrestrained joy. Some of our expansion efforts - largely initiated by your Chairman have been lackluster, others have been expensive failures. We entered the business in 1967 through purchase of the segment which Phil Liesche now manages, and it still remains, by a large margin, the best portion of our insurance business. It is not easy to buy a good insurance business, but our experience has been that it is easier to buy one than create one. However, we will continue to try both approaches, since the rewards for success in this field can be exceptional.

我们将继续寻找扩大保险业务的途径。 但你们对这一意图的反应不应期待值过高。 我们的一些扩张努力--主要是由你们的董事长发起的--乏善可陈,而另一些则因代价高昂而放弃。 我们在 1967 年通过购买 Phil Liesche 现在管理的部分进入了这一业务领域,而且在很大程度上,它仍然是我们保险业务中最好的部分。 购买一家好的保险企业并不容易,但我们的经验是,购买一家企业比创建一家企业更容易。 不过,我们将继续尝试这两种方法,因为在这一领域取得成功的回报可能会非常丰厚。

心得:不同于纺织业,在巴菲特看来,保险业是一个长期资本回报率丰厚的行业,因此会重点通过并购,辅以新创的手段,持续在这个业务板块进行扩张。虽然,其此前谈到,保险业是一个很难在产品和销售端做出差异化进而赚取溢价的行业,同时长期来看通货膨胀的持续上升以及社会观念的变化会导致成本上升,进而可能导致承保损失的可能性增加。但在出色的管理者的领导下,借助这些管理者出色的经营管理能力实现负债端的成本不断下降,以及通过出色的资本配置和投资能力实现资产端的收益不断上升,最终是能够获得丰厚的资本回报的。不像纺织业,其负beta效应会极大地吞噬管理带来的alpha效应,保险行业中管理带来的alpha效应是丰厚资本回报的核心来源。