嘉信理财的流动性风险(本文仅供娱乐)

“如果银行不要求我们归还贷款,我们就不会出问题”。这段话是安然的一位高管在安然破产后说的一句话,对一家资产负债表有严重问题的公司来说,如果可以继续通过制造虚假营收、公允价值会计的滥用、持续向表外转移不良资产,那么就可以制造利润表上的繁荣。在泡沫破灭前,一切欣欣向荣!但真正的危机,正在逼近。"At your highest moment, be careful, that's when the devil comes for you.”

下面我们将以文字的形式对接下来可能的危机做一轮推演(仅供娱乐),我们从嘉信理财的资产负债表开始。

一、资产端

结合嘉信理财2024年财报,公司在资产端可以用于应对流动性风险的工具依次为:

1、现金及现金等价物420.83亿美元,其中,包含卖出回购所得款项100.75亿美元。

2、AFS类别债券资产829.94亿美元(摊余成本计量为897.04亿美元),这部分资产的价值仅有公允价值的一半,如果大量出售将触发硅谷银行似的危机。

3、HTM类别债券资产1464.53亿美元,这部分资产的价值与AFS类似,一旦出售将产生大量亏损。

4、Margin loans,828.15亿美元。由于这部分的资产收益率较高,嘉信理财如果通过收回贷款增加流动性,则将对公司业绩形成较大影响。此外,在市场遭遇流动性危机期间,这部分贷款能否提前、及时收回是个问号。

5、此外,公司还有交给监管机构的各类准备金,但这里面有多少可以用来应对突发的流动性需求?

综上,嘉信理财在资产端用于应对流动性风险的资产仅为420.83亿美元,考虑到公司需要预留部分营运资金,在资产端可以用于应对流动性危机的资产估计不超过300亿美元。对于一家存款规模近2600亿美元的公司来说,十分紧张。

二、负债端

在负债端,用于应对流动性风险的工具为:

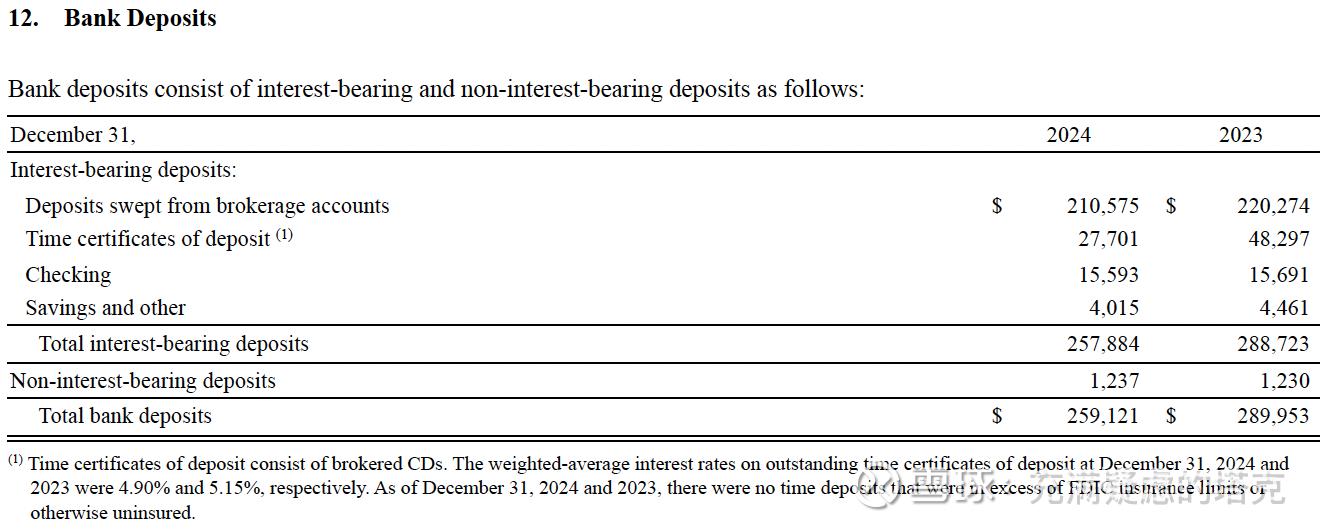

1、客户存款:截止2024年末,该科目的余额为2591.21亿美元,如果存款规模下降420.83亿美元,也即存款规模减少16.24%,则将触发公司流动性危机的第一阶段。嘉信理财将不得不用更高的融资成本借款来维持公司的流动性。

2、FHLB的借款额度:Our banking subsidiaries maintain secured credit facilities with the FHLB. Amounts available under these facilities are dependent on the amount of bank loans and the value of certain investment securities that are pledged as collateral.There was $16.7 billion and $26.4 billion outstanding under these facilities as of December 31, 2024 and 2023, respectively, and these borrowings had a weighted-average interest rate of 5.11% and 5.34%, respectively. As of December 31, 2024 and 2023, the collateral pledged provided additional borrowing capacity of $59.8 billion and $63.1 billion, respectively. 但这部分通过交付抵押品获取的信贷额度是否能顺利使用有个潜在的问题,嘉信理财的所有者权益必须为正。我们预期,在公司遭遇流动性危机的时候,会首先动用FHLB的借贷额度,而把出售AFS和HTM债务资产作为不得已的选项。截止2024年末,公司在FHLB的借贷额度已经使用的部分为167亿美元,还有额外的598亿美元可以动用来应对流动性危机。

3、其他短期借贷:截止2024年末,嘉信理财的卖出回购借款为55亿美元。Total other short-term borrowings outstanding at December 31, 2024 and 2023 were $6.0 billion and $6.6 billion, respectively, and had a weighted-average interest rate of 5.21% and 5.57%, respectively. Additional information regarding our other short-term borrowings facilities is described below. The Company may engage with external financial institutions in repurchase agreements collateralized by investment securities as another source of short-term liquidity. The Company had $5.5 billion and $4.9 billion outstanding pursuant to such repurchase agreements at December 31, 2024 and 2023, respectively. Repurchase agreements outstanding at December 31, 2024 mature between January 2025 and May 2025.

4、长期借贷:公司在2024年没有发行长期债务,2023年发行的长期债务利率已经介于5.6%-6.2%之间了。嘉信理财可能考虑这部分借款的利率过高,但副作用是公司负债端的稳定性变差,借短投长问题更加严重。

5、美联储的窗口信贷:通过提交抵押品获得305亿美元的信贷额度。Our banking subsidiaries have access to funding through the Federal Reserve discount window. Amounts available are dependent upon the value of certain investment securities that are pledged as collateral. As of December 31, 2024 and 2023, our collateral pledged provided total borrowing capacity of $30.5 billion and $6.2 billion, respectively, of which no amounts were outstanding at the end of either year. During the first quarter of 2024 and the year ended December 31, 2023, our banking subsidiaries had access to funding through the Federal Reserve Bank Term Funding Program (BTFP). This program offered loans through March 11, 2024 of up to one year in length, and amounts available were dependent upon the par value of certain investment securities pledged as collateral. This facility was not used in 2024 or 2023, and as of December 31, 2024, there was no collateral pledged under the BTFP. As of December 31, 2023, our collateral pledged provided total borrowing capacity of $39.2 billion.

6、商业票据发行能力:50亿美元。CSC has the ability to issue up to $5.0 billion of commercial paper notes with maturities of up to 270 days. There were no amounts outstanding at December 31, 2024 or 2023. CSC and CS&Co also have access to unsecured uncommitted lines of credit with external banks with total borrowing capacity of $1.7 billion; no amounts were outstanding at December 31,2024 or 2023.

其他:CS&Co maintains secured uncommitted lines of credit, under which CS&Co may borrow on a short-term basis and pledge either client margin securities or firm securities as collateral, based on the terms of the agreements, under which there was $500 million outstanding at December 31, 2024 and $950 million outstanding at December 31, 2023. TDAC also previously maintained secured uncommitted lines of credit. Prior to the final client account conversions to CS&Co from the Ameritrade broker-dealers, TDAC could borrow on either a demand or short-term basis and pledged client margin securities as collateral. The TDAC lines of credit were terminated during 2024. There was $700 million outstanding under the TDAC lines of credit at December 31, 2023.

综上,在负债端,嘉信理财可以动用的资金额度主要为:FHLB的借贷额度598亿美元;美联储窗口信贷305亿美元,两项合计为903亿美元。此外,还有商业票据发行能力50亿美元(但在流动性危机期间该工具是否还能正常使用,打个问号)。当一家金融机构过于依赖于政府机构的短期信贷时,往往是一家公司财务不健康的标志。如果大规模使用此类贷款,相当于跟市场讲“我们的财务情况比较脆弱”,进而降低市场对该机构的信心。

三、危机预演

1、在危机的第一阶段,嘉信理财将通过动用账面现金资产应对流动性需求,上限为300亿美元。这时,公司账面的可用资金将下降到100亿出头的水平,已经比较危险了。

2、危机的第二阶段,公司将开始动用FHLB的借贷额度598亿美元和美联储的窗口信贷305亿美元,两者合计将为嘉信理财提供最高903亿美元的资金。这部分资金在理论上可以支持公司渡过流动性危机,但代价将是公司的利息成本飙升。按照最低5.11%的短期借贷利率计算,这部分增量信贷如果全部动用,年化利息支出将达到46.14亿美元。2024年嘉信理财的所得税前盈利为76.92亿美元,全额使用贷款将使得公司税前盈利下降60%。

3、危机的第三阶段,公司将开始大规模出售债务类证券,从AFS开始,然后是HTM。但由于公司高质量的抵押品已经交付给了FHLB和美联储,并且有一部分提交给了其他交易对手作为卖出回购的抵押品。剩余的这些低质量债务证券一旦出售,折价率将非常高,公司账面将出现巨额亏损,从而使得公司陷入类似硅谷银行的困境。也即,一旦嘉信理财无法度过危机的第二阶段,在第三阶段将是死局。

四、其他风险

1、FHLB发现嘉信理财事实上已经资不抵债(所有者权益为正是FHLB的贷款要求),拒绝其使用承诺的信贷额度。

2、随着经济衰退,公司已发放的各项贷款需要集中计提减值(公司针对其各类信贷资产几乎没有计提任何减值,简直准备严重不足)。其中就包含违约风险无法精确预计的Margin loans。2024年嘉信理财的利息收入总计为155.37亿美元,其中:Margin loans贡献的利息收入为54.2亿美元(高于AFS和HTM债券合计贡献的利息收入),相比上年同期的47.93亿美元增长13%;Margin loans的余额为838.15亿美元,上年同期为625.82亿美元。计算下来,2024年度嘉信理财margin loans的平均年化收益率约为6.46%。占全部利息收入的比重为34.88%。并且针对此类信贷,公司没有计提减值,仅仅标注了一段话:The allowance for credit losses for receivables from brokerage clients and related activity were immaterial for all periods presented. 考虑到当前市场的极端性,嘉信理财的828.15亿贷款真的不会出现任何不良么?事实上这类贷给各类投机者的保证金贷款是风险极高的品种。如果有5%的不良率,则将影响公司税前利润41.4亿美元。

3、资本市场转冷导致嘉信理财的交易类业务收入和利润下降。那么,公司将遭遇资产负债表和利润表的双重打击。